Services

Operating hours

In accordance with the requirements of the SCT Inst scheme, TIPS operates 24 hours a day, seven days a week and 365 days a year, including on official TARGET holidays.

Funds made available for the settlement of instant payments are left on TIPS accounts when T2 is closed so that operations can continue smoothly.

T2 business days are authoritative for TIPS – that is to say, one business day ends and the next one begins shortly after 18:00, Monday to Friday.

Payment settlement

TIPS settles instant payments according to the requirements formulated by the European Payments Council (EPC) in the SEPA Instant Credit Transfer (SCT Inst) scheme.

Thus, an SCT Inst payment should have an end-to-end processing time between scheme participants of ten seconds or less. This time begins when the originator’s payment service provider applies a time stamp as soon as it has completed all the necessary checks and blocked the amount to be transferred on the originator’s account.

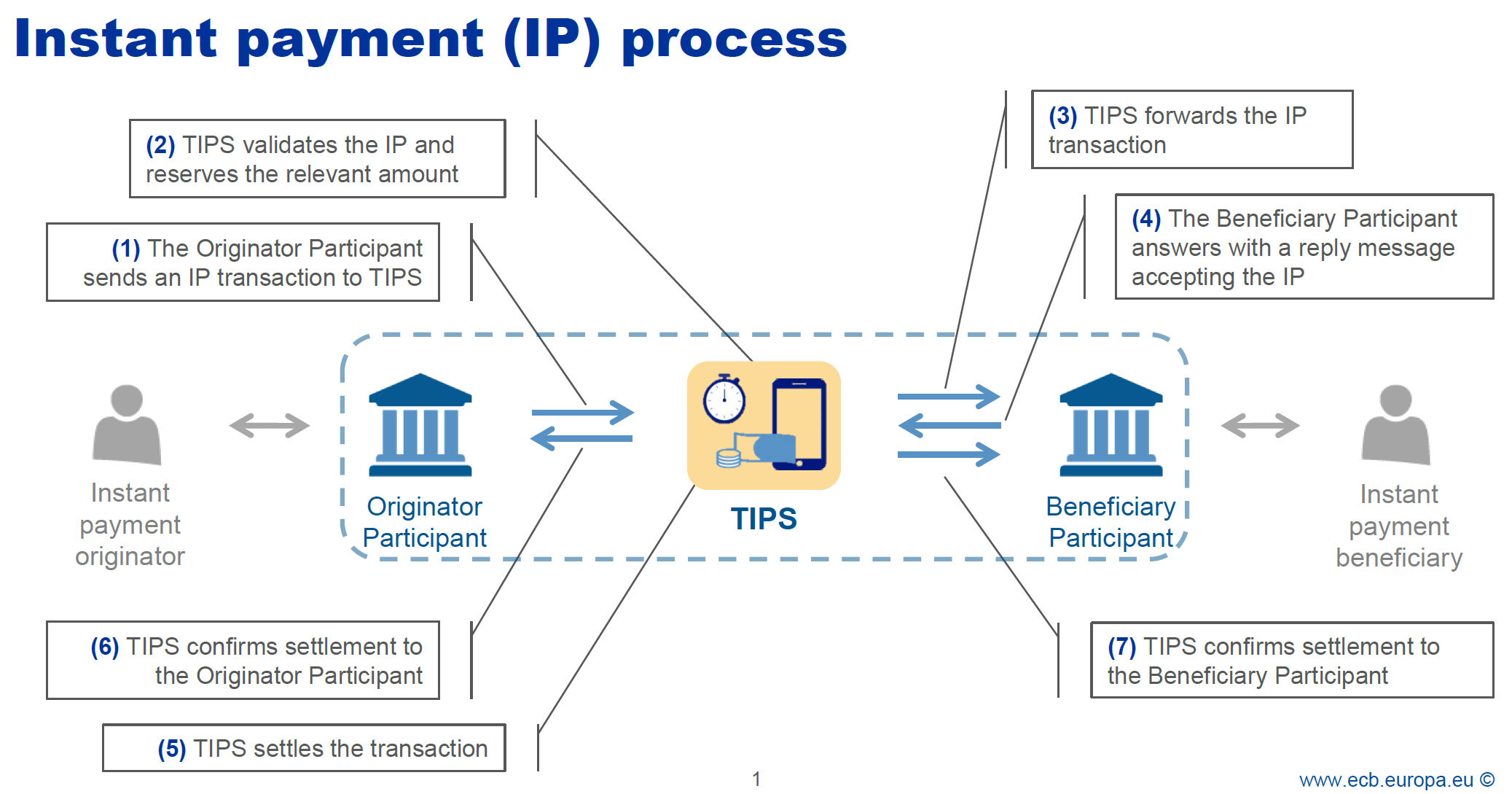

When TIPS receives an SCT Inst payment transaction message, the amount to be transferred is blocked on the TIPS account of the participant sending the payment and the message is forwarded to the payment service provider receiving the payment for acceptance. This receiving participant sends either a positive or a negative reply. If the reply is positive, TIPS will perform settlement; if it is negative, the blocked amount is released again. In both cases, the sending participant will be notified about the successful or failed transaction. Once the beneficiary’s payment service provider has received confirmation from TIPS, it can make the transferred amount available to the beneficiary.

TIPS works on a transaction-by-transaction basis – i.e. each payment is processed and settled individually. By their very nature, instant payments need to be settled immediately or almost immediately, so transactions should not be queued or held for later processing. This is why transactions are immediately rejected if there is insufficient cover on the TIPS account to be debited. Payments cannot be prioritised – transactions are processed in the order in which the system received them.

Payment messages under the SCT Inst scheme are based on the ISO 20022 standard. TIPS also uses XML format for messages which are not prescribed by the scheme (e.g. liquidity transfers and notifications).

The addressing of TIPS payments is supported by a TIPS directory, which lists all the BICs which can be addressed via TIPS.

Liquidity provision

TIPS uses TIPS Dedicated Cash Accounts (or TIPS-DCAs for short) to settle instant payments. These accounts are operated on a credit basis in TIPS and can be supplied with liquidity from the Main Cash Account (MCA) or any DCA operated in one of the TARGET Services. Liquidity transfer orders can be instructed in either U2A mode (using the graphical user interfaces) or A2A mode.

Liquidity can only be transferred between the TARGET Services during T2 opening hours. Outside these hours, credit balances provided for the settlement of instant payments will remain on the TIPS accounts so that operations can continue smoothly. In other words, they are not automatically transferred back to the MCA at the end of the business day. Furthermore, TIPS accounts can be provided with liquidity through incoming instant payments.

TIPS participants that additionally process instant payments in an ancillary system, can fund or defund their liquidity position within the ancillary system via their TIPS DCA. To this end, liquidity transfers within TIPS between TIPS DCAs and the technical accounts held by ancillary systems, can be instructed around the clock.

Liquidity management

Holders of TIPS accounts can set floor and ceiling amounts so that they are notified whenever the account balance exceeds or falls below a certain level. If other institutions or branches are set up as reachable parties (see the “Participants” navigation item), account holders can restrict the use of the TIPS account by setting individual limits.

At the end of every business day, the credit balances on a TIPS DCA are counted towards compliance with the minimum reserve requirement and when making recourse to automated overnight credit.

Technical access

Technical access to TIPS is facilitated via the Eurosystem Single Market Infrastructure Gateway (ESMIG). The ESMIG provides a single access point for directly connected actors to access TARGET Services. Access to the ESMIG is provided by the two Network Service Providers (NSP) selected by the Eurosystem, which are SIA-COLT and SWIFT.

Due to the tight time requirements for SCT Inst payments, payments can only be exchanged on an automated basis, i.e. in application-to-application mode (A2A). There is also a graphical user interface for liquidity and reference data management as well as for queries about individual payments (user-to-application mode – U2A).

Reference data

Reference data for TIPS are recorded and maintained mainly in CRDM, the Common Reference Data Management component, which is used jointly by the TARGET services.

The vast majority of reference data for TIPS is collected via the CRDM graphical user interface (CRDM GUI).It is possible to input and modify data in CRDM during T2 operating hours. Before the change of the business day, at around 17:00, the reference data valid for the following business day are transferred from CRDM to TIPS.

Since instant payments can be settled in TIPS around the clock, it must be possible to modify some reference data at any time – even on weekends and public holidays. This category includes, for example, adjusting limits or blocking accounts. To facilitate this, such reference data are maintained directly in TIPS instead of CRDM, and can thus be modified 24/7.

Upon opening a TIPS account, the reference data are input by the National Service Desk for TARGET services on the basis of the forms submitted. Any additional entries (e.g. creating users and assigning roles) must be made by the participants themselves, which is why each participant needs U2A access.