Acquisition of financial assets and external financing in Germany in the fourth quarter of 2021 Results of the financial accounts by sector

Debt ratio of households continues to decrease slightly

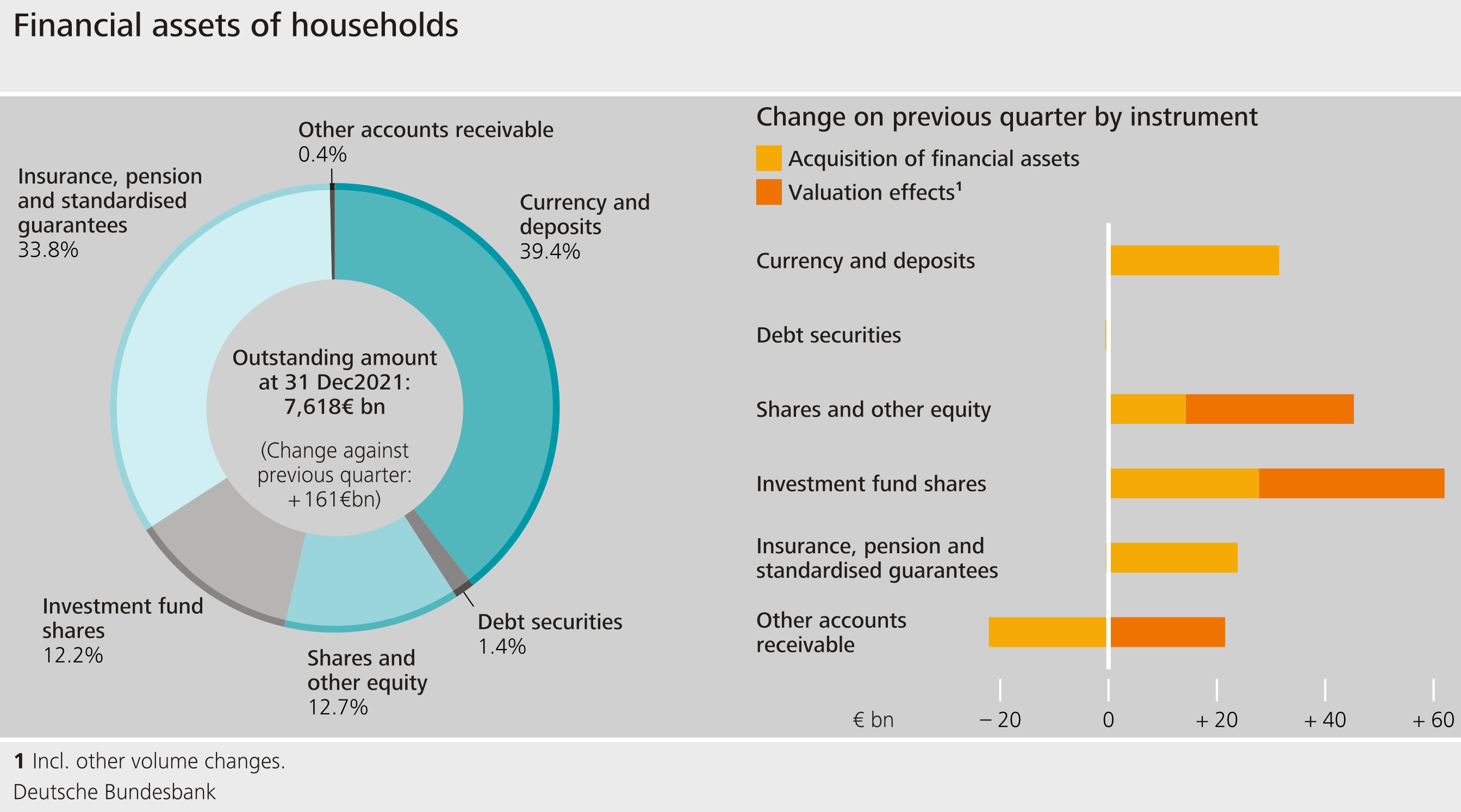

Households’ financial assets grew by €161 billion to €7,618 billion in the fourth quarter of 2021. Taking all transactions and valuation effects into account, growth was thus significantly higher than in the (weak) third quarter.

The transaction-related increase in financial assets (€75 billion) stood at a level similar to valuation effects (€86 billion). The latter was driven mainly by price gains to the tune of €34 billion for investment fund shares and of €21 billion for foreign shares. The valuation gains recorded in the previous quarter for both of these items were considerably smaller. Households upped their holdings of currency and transferable deposits by €31 billion, which was also more than in the previous quarter. By contrast, debt securities were rather stable. Investment fund shares and claims on insurance corporations were acquired on much the same scale as in the previous quarter.

At €2,043 billion, households’ liabilities were €22 billion higher than in the third quarter of 2021. This increase was in large parts due to housing loans. The debt ratio, defined as total liabilities as a percentage of nominal gross domestic product (four-quarter moving sum), dipped slightly to 57.2%. This was due in part to the increased economic activity over the course of 2021.

At the end of the fourth quarter, households’ net financial assets stood at €5,575 billion.

High financing needs among non-financial corporations

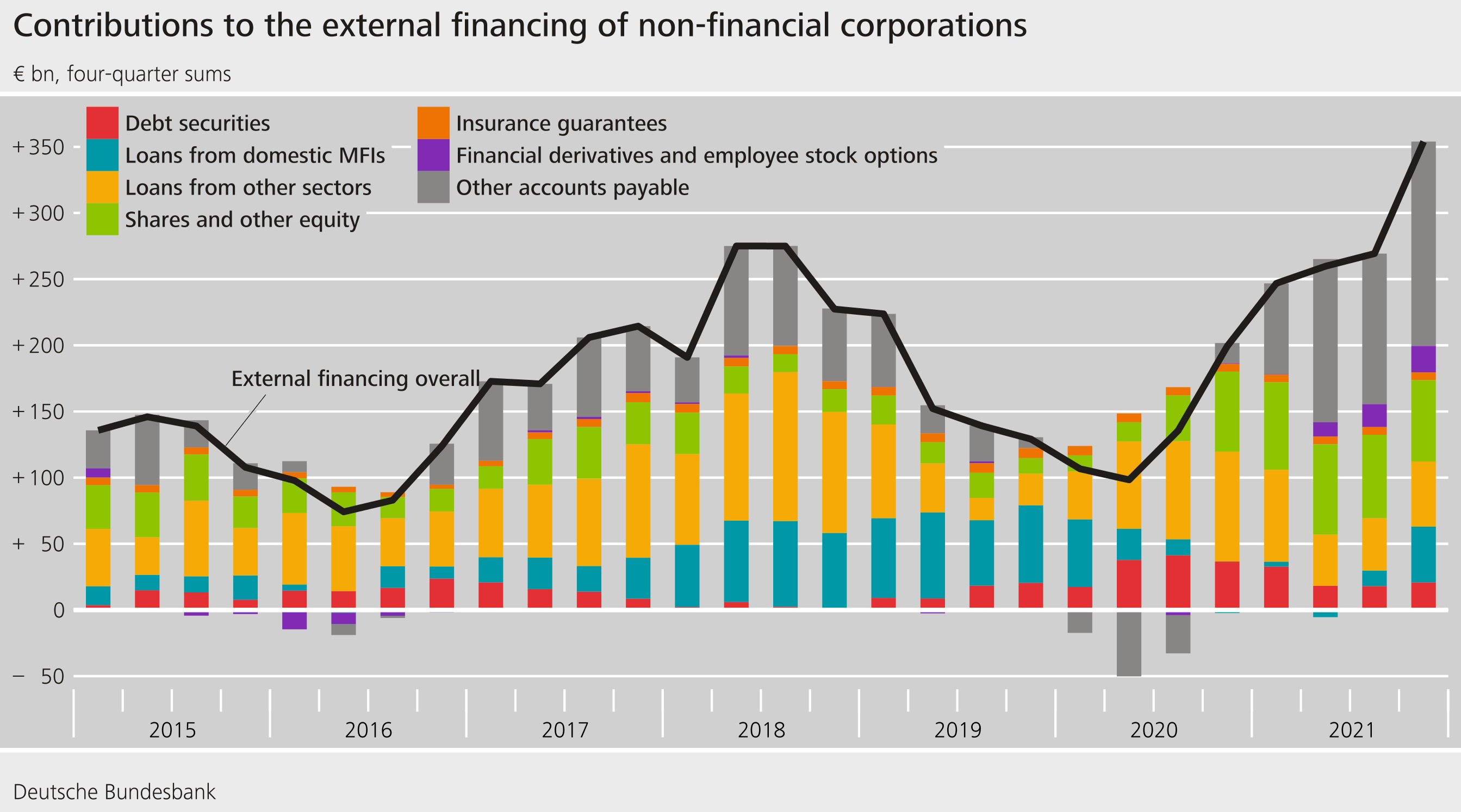

At €137 billion, non-financial corporations’ external financing was exceptionally high in the reporting quarter. This was the result of similar developments in several instruments. Non-financial corporations took out €49 billion in new loans. Providing a funding volume of €23 billion, domestic banks were the biggest lenders. Inflows of funds from issuing shares and other equity made a further €20 billion available to non-financial corporations. Trade credits and advances also made a significant contribution to non-financial corporations’ external financing in the fourth quarter, accounting for €63 billion. It was only debt securities that made a slightly negative contribution to external financing, with redemptions exceeding issuance by €1 billion.

In annual terms (four-quarter moving sums), the upward trend in external financing, which had flattened somewhat recently, was put back on a far steeper trajectory. In addition to other accounts payable, which chiefly comprise trade credits and advances, this development was driven mainly by loans from domestic banks, which have been steadily gaining in importance again since the end of 2020.

The liabilities of non-financial corporations continued to see strong growth, standing at €8,162 billion at the end of the fourth quarter of 2021. However, as gross domestic product increased in almost equal measure, non-financial corporations’ debt ratio remained unchanged on the quarter, at 81.1%. Non-financial corporations’ debt ratio is calculated as the sum of loans, debt securities and pension provisions as a percentage of nominal gross domestic product (four-quarter moving sum).

The financial assets of non-financial corporations grew by €70 billion over the course of the quarter, amounting to €5,976 billion at the year’s end. At €154 billion, the transaction-related acquisition of financial assets was significantly higher than growth in holdings. The fact that growth in non-financial corporations’ financial assets was not higher still was in large part attributable to valuation losses on claims from financial derivatives. Mirroring this, however, similar valuation losses were also observed on the non-financial corporations’ liabilities side. Overall, therefore, non-financial corporations’ net financial assets broadly moved sideways and amounted to -€2,186 billion at the end of 2021.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.