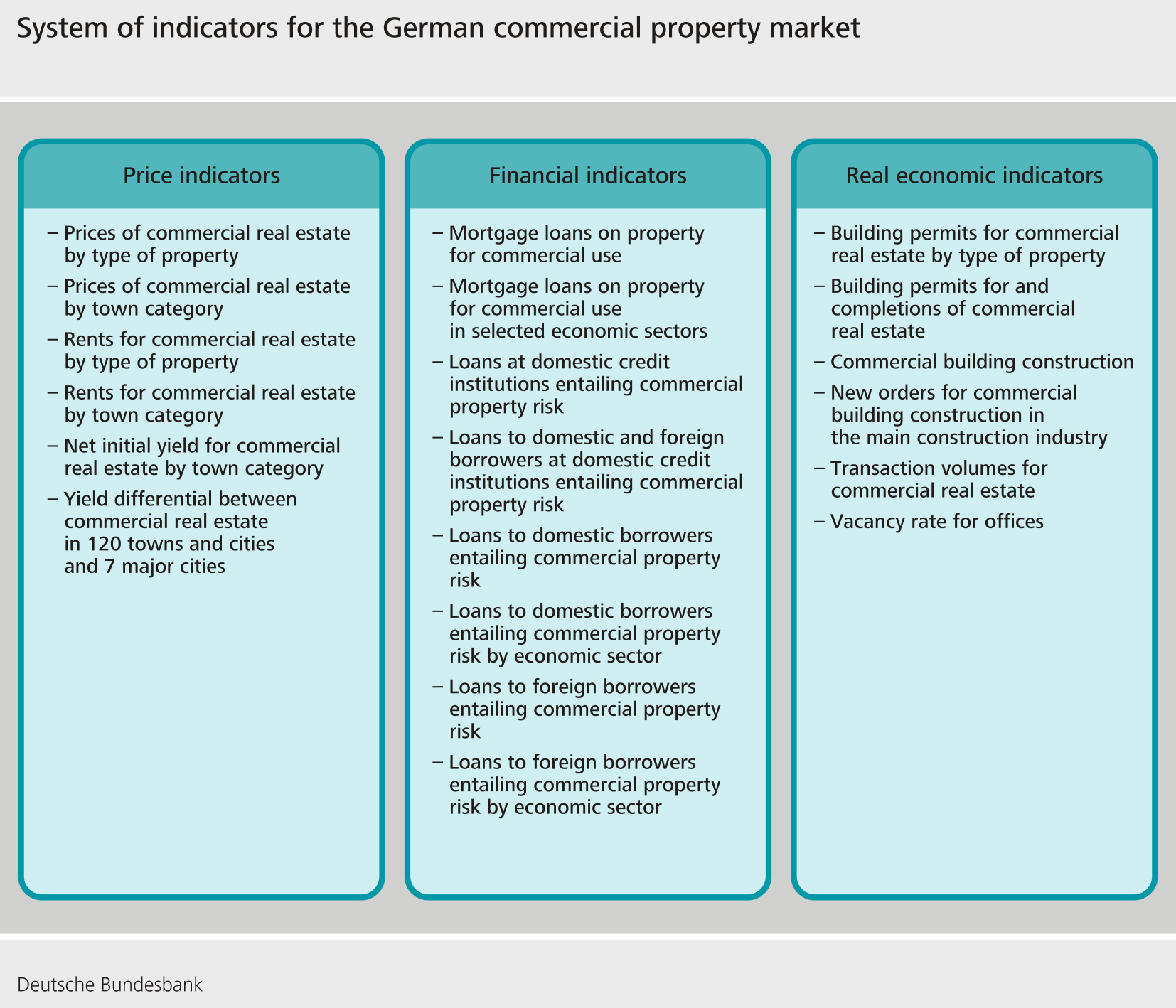

System of indicators for the German commercial property market

The system of indicators provides users with a concise overview of the situation on the commercial real estate market, with the indicators describing current developments in this market segment from three perspectives: in terms of prices, financing and the real economy.