Acquisition of financial assets and external financing in Germany in the third quarter of 2022 Results of the financial accounts by sector

Decline in households’ financial assets continues

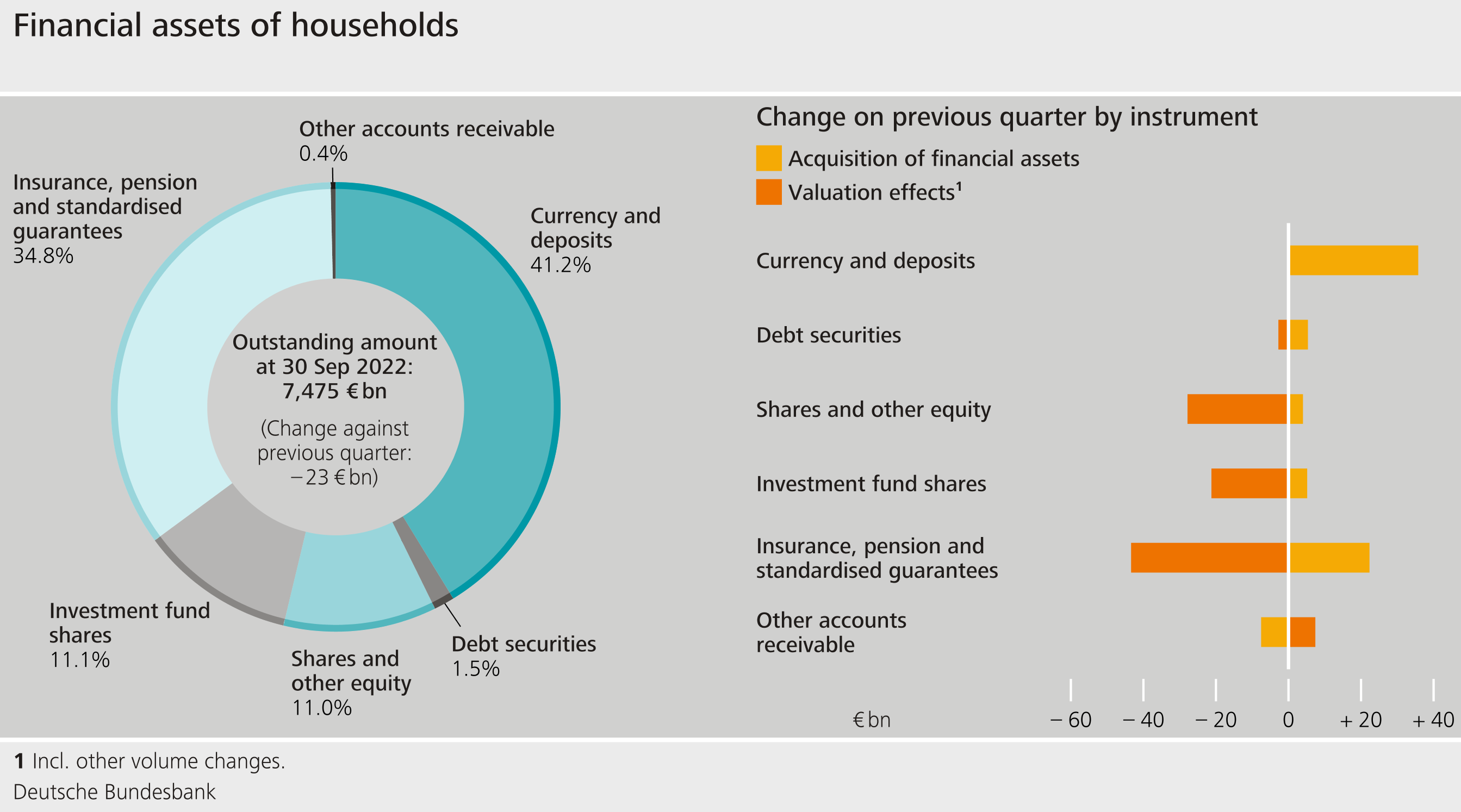

In the third quarter of 2022, households’ financial assets shrank for the third time in a row owing to persistent valuation losses. A phase of negative growth in financial assets lasting longer than this was last seen during the global financial crisis. At the end of the third quarter of 2022, households’ financial assets amounted to €7,475 billion. Although households built up claims in the amount of €65 billion, this accumulation of assets did not compensate for their valuation losses of around €88 billion. On balance, financial assets declined by €23 billion.

Pension and insurance claims held by households saw the greatest loss in value, of €43 billion. However, price losses were also recorded for shares and other equity (€28 billion), investment fund shares (€21 billion) and debt securities (€3 billion). Overall, though, valuation losses were smaller than in the second quarter of 2022.

At €65 billion, the increase in total financial assets driven by transactions was significantly lower than the average of the last five quarters. Households again significantly topped up their holdings of currency and deposits by €36 billion, but acquired much lower volumes of equity and investment fund shares than in the previous quarter, at €4 billion and €5 billion respectively. However, the slight upward trend in the acquisition of debt securities continued.

Household’s liabilities continued to increase, amounting to €2,118 billion at the end of the reporting quarter. That is €29 billion more than in the second quarter. Even so, the debt ratio remained unchanged at 55.8%, which is due to the increased aggregate output in the third quarter. The debt ratio represents debt as a percentage of nominal gross domestic product (four-quarter moving sum). In the aggregate, households’ net financial assets also fell for the third time in succession, and amounted to €5,357 billion.

Borrowing by non-financial corporations reaches highest level since 2000

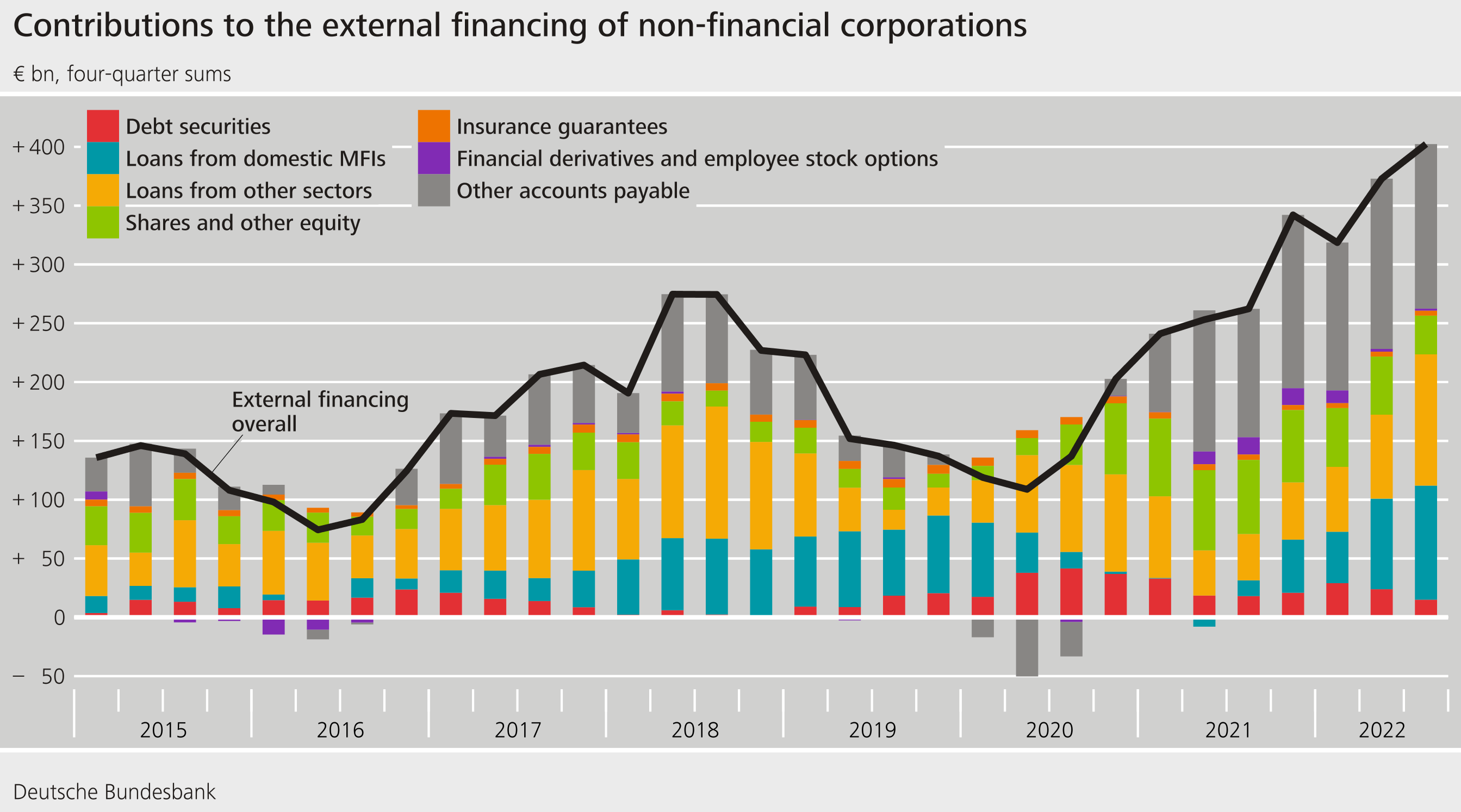

In the third quarter of 2022, the external financing of non-financial corporations increased sharply to €115 billion. This was mainly due to the high level of borrowing, which, at €83 billion, reached its highest level since the fourth quarter of 2000. Borrowing was related partly to government assistance loans to energy firms, but was also noticeably positive otherwise. With a total financing volume of €27 billion, general government was the main lender. Non-financial corporations borrowed €25 billion from domestic monetary financial institutions. The third quarter of 2022 also saw Porsche AG’s initial public offering. This resulted in a higher issuance volume of listed shares. Porsche AG equity was previously recorded as unlisted shares, meaning that there was a decline in this figure.

The external financing of non-financial corporations thus accelerated further in annual terms (four-quarter moving sums). This was likewise largely attributable to a high level of borrowing. Similarly high external financing figures were last seen in the early 2000s.

At the end of the third quarter of 2022, the financial assets of non-financial corporations stood at €6,221 billion, which was €124 billion more than in the previous quarter. Transactions pushed up financial assets by €68 billion. Transactions in currency and deposits were exceptionally high, reaching a new peak at €51 billion.

Much like households non-financial corporations suffered valuation losses on the shares and other equity they held (€35 billion). However, negative developments on the stock exchanges also affected the liabilities of non-financial corporations. For the third time in a row, the shares and other equity they issued saw valuation losses (€155 billion). Owing to sharply increased external financing the liabilities of non-financial corporations ultimately rose slightly and stood at €7,780 billion at the end of the quarter.

Because of these increased liabilities, the debt ratio went up to 81.1% and is thus more or less at the level of the last 2 years. The debt ratio is calculated as the sum of loans, debt securities and pension provisions as a percentage of nominal gross domestic product (four-quarter moving sum).

On aggregate, non-financial corporations’ net financial assets increased slightly to -€1,559 billion at the end of the quarter. The net acquisition of financial assets totalled -€48 billion.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.