October results of the Bank Lending Survey (BLS) in Germany Banks tighten credit standards

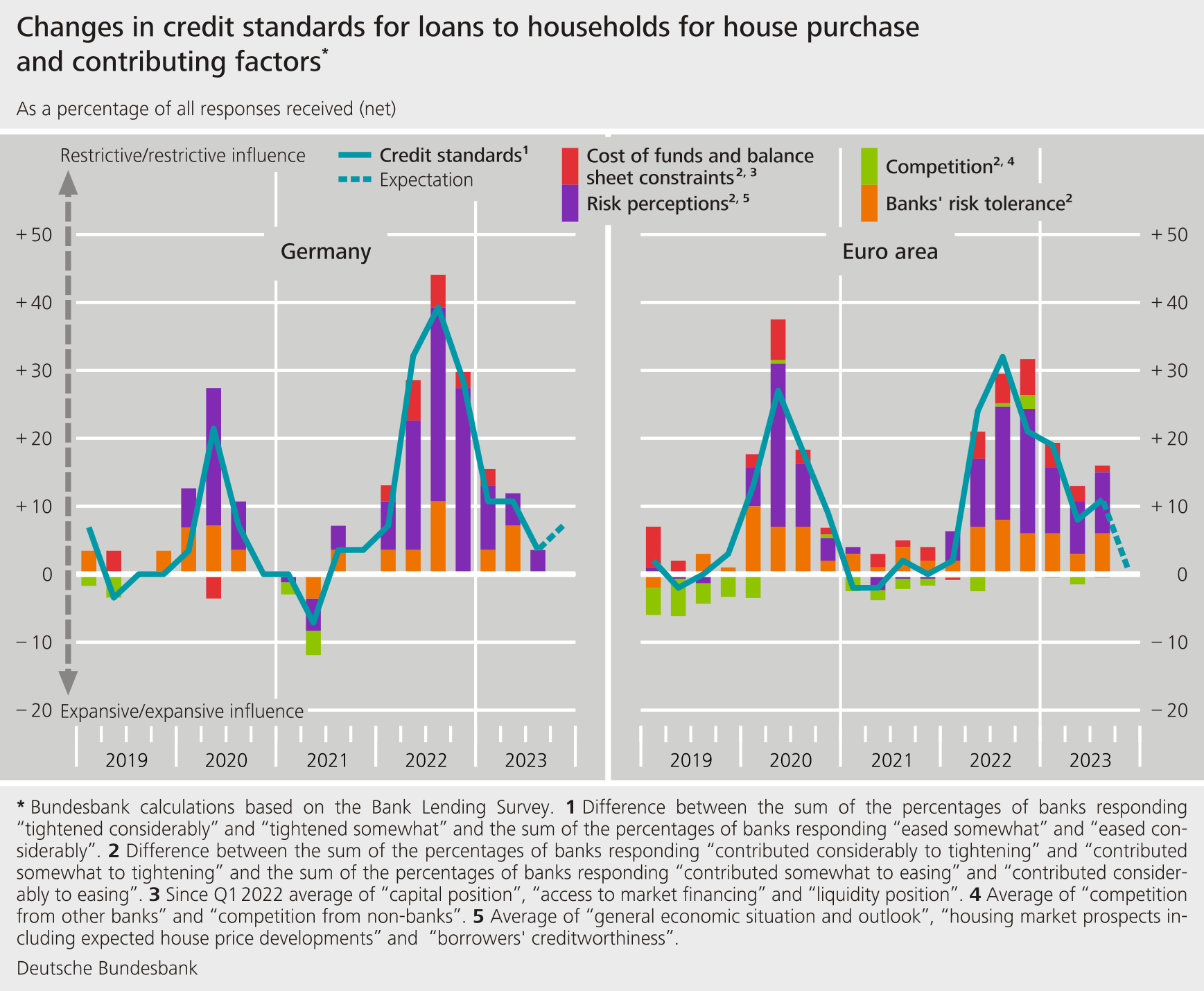

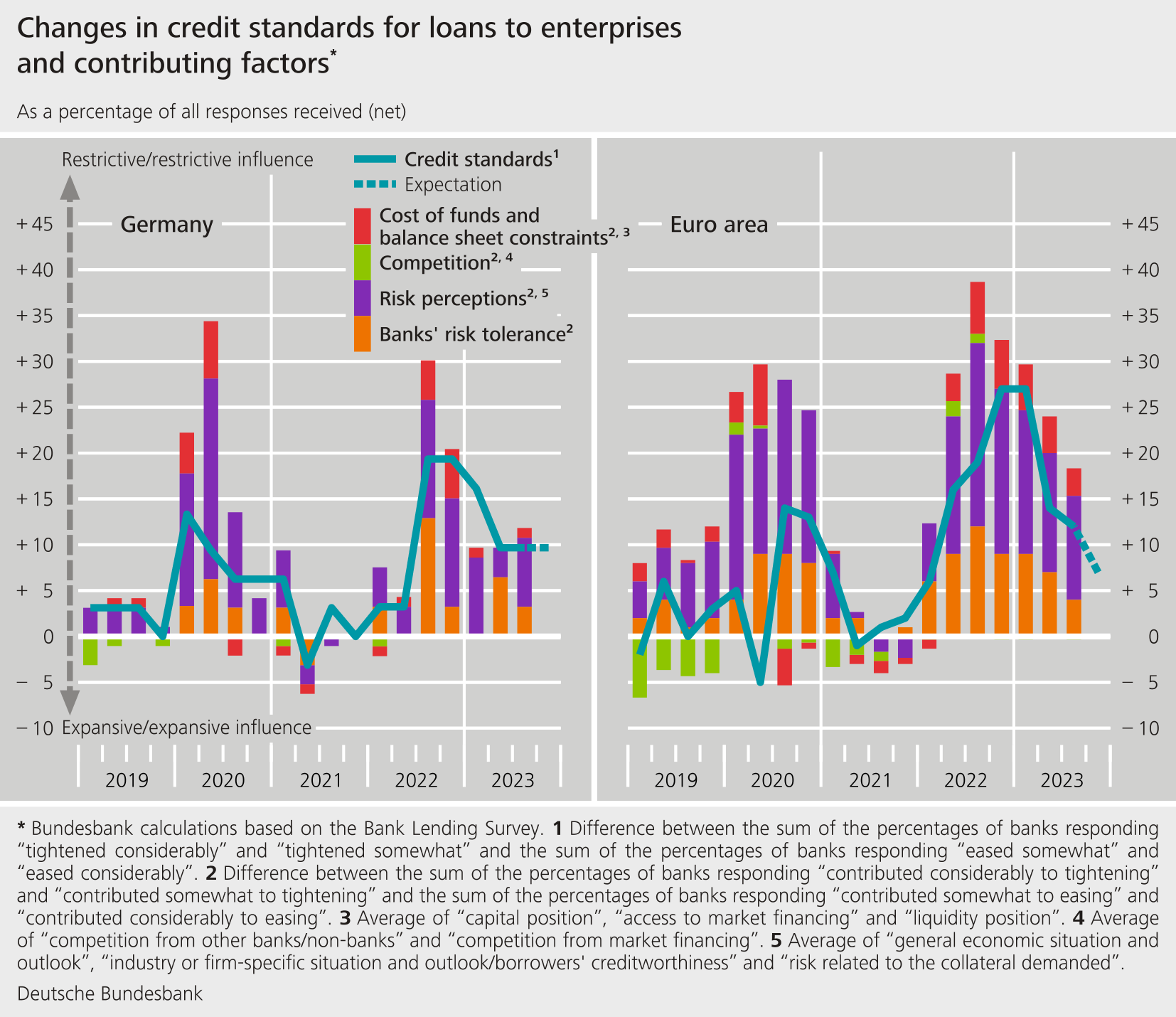

- The German banks responding to the Bank Lending Survey (BLS) tightened their credit standards for loans to enterprises, loans to households for house purchase, and consumer credit and other lending again in the third quarter of 2023. Just a quarter earlier, the banks had still professed unwillingness to meaningfully tighten their credit standards any further.

- Credit terms and conditions were tightened for loans to enterprises and for loans to households for house purchase. This was reflected in increased margins on riskier loans, in particular.

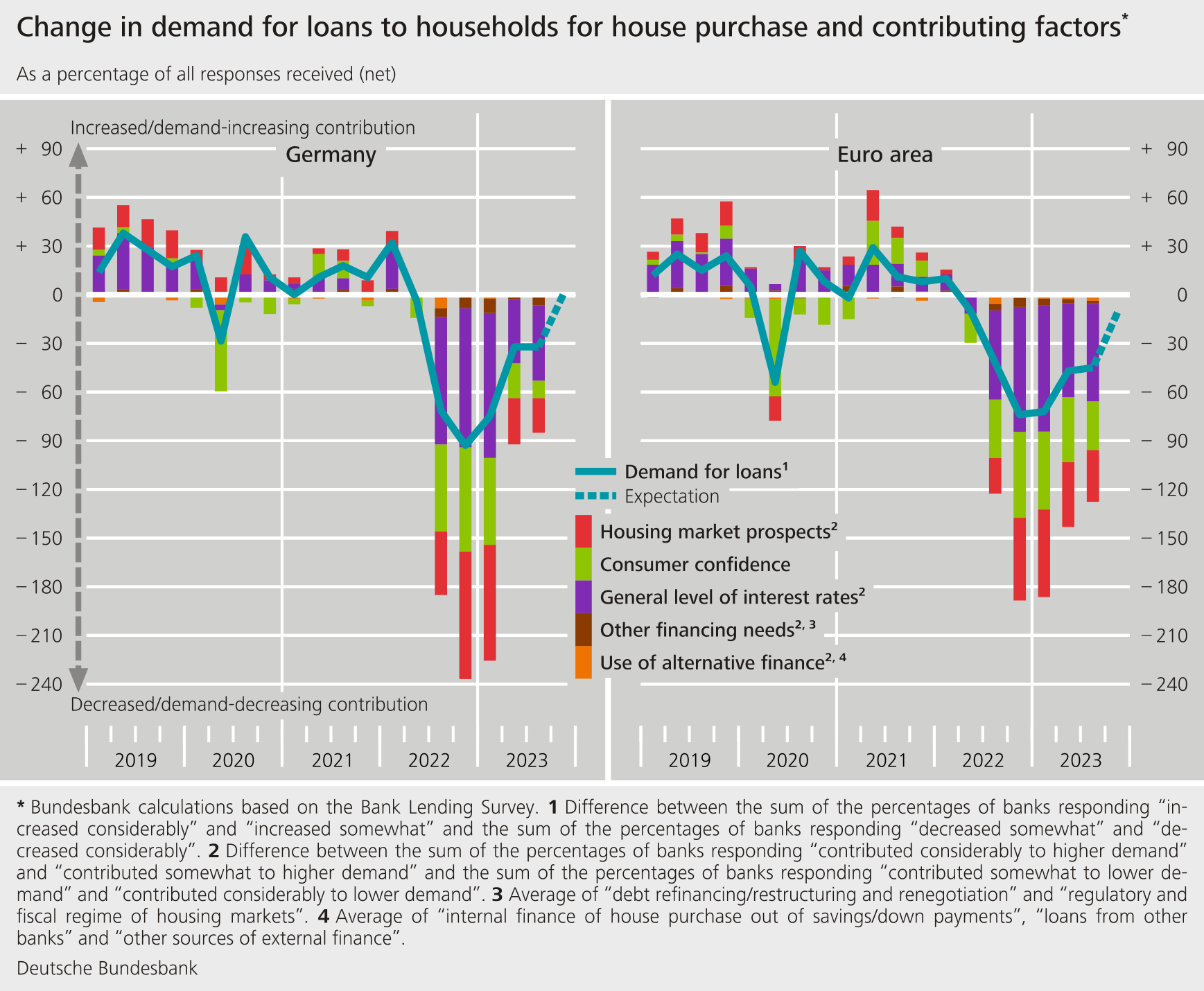

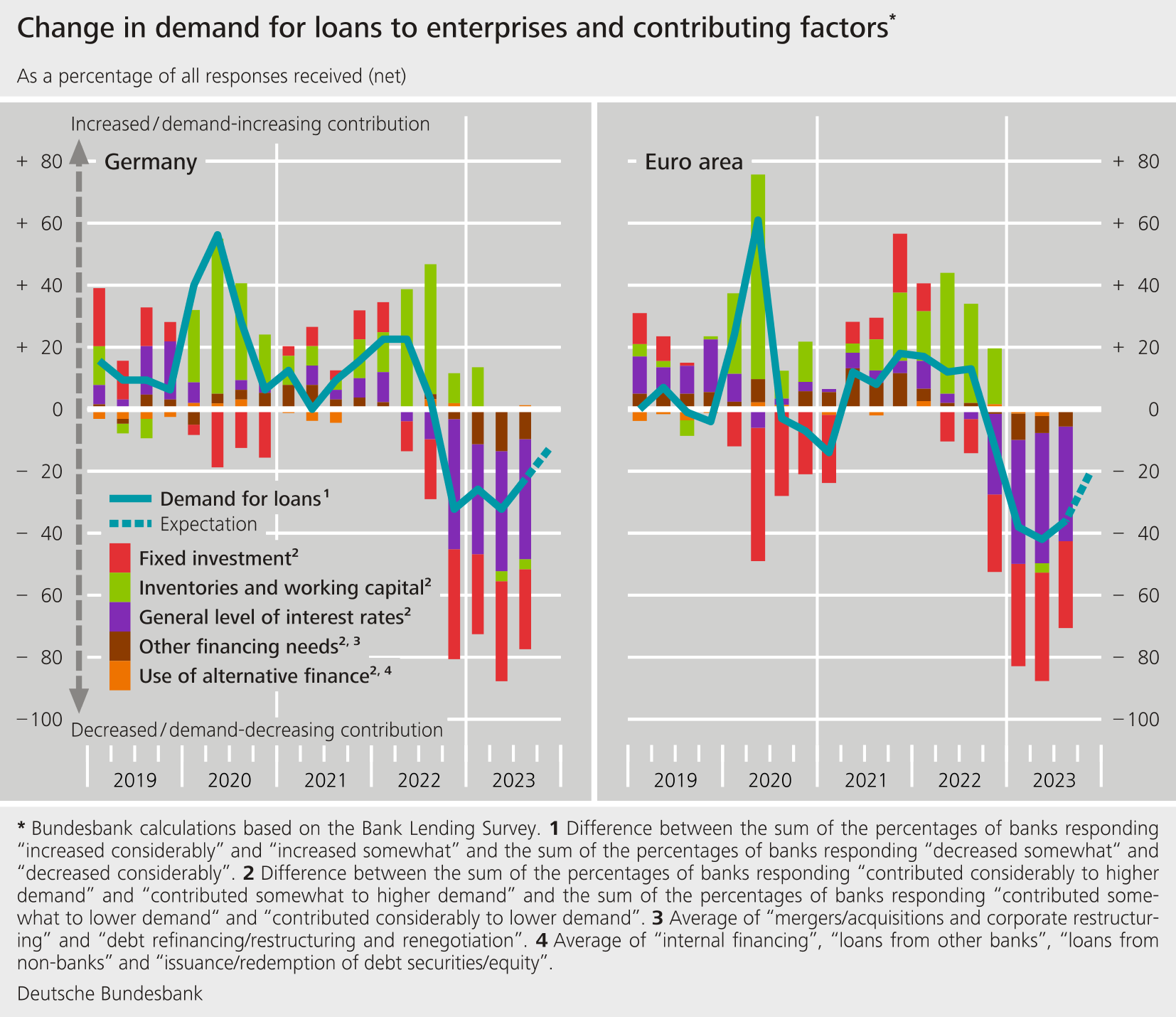

- Demand declined further in all three loan categories even though, in the previous quarter, the banks had expected demand to remain virtually unchanged.

- The Eurosystem’s policy rate hikes contributed, via a positive impact on net interest income, to an improvement in banks’ profitability in the 2023 summer half-year.

The BLS covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. On balance, the surveyed banks tightened their credit standards (i.e. their internal guidelines or loan approval criteria) in all three loan categories. The net percentage of banks that tightened their requirements was +10% for loans to enterprises (compared with +10% in the previous quarter), +4% for loans for house purchase (compared with +11% in the previous quarter), and +7% for consumer credit and other lending (compared with +14% in the previous quarter). Banks justified these stricter requirements for all loan categories based on what they perceived to be elevated credit risk.

Loans to enterprises saw an increase in risk, especially regarding industry-specific and firm-specific factors. The deterioration in the general economic situation and the subdued economic outlook were the key factors in business with households. For the fourth quarter of 2023, the banks are, on balance, planning to tighten their credit standards further in all three loan categories.

The banks also once again tightened their credit terms and conditions (i.e. the terms and conditions actually approved as laid down in the loan contract) across the board. This was reflected primarily in increased margins on riskier loans.

Demand for bank loans in Germany continued to decline on balance in all three loan categories, particularly loans to enterprises and loans to households for house purchase. In the previous quarter, however, the banks had been expecting demand to remain virtually unchanged. In all three loan categories, the general level of interest rates continued to be the key factor behind the drop in demand for loans.

Falling fixed investment was the second most important factor behind the decline in demand for loans to enterprises. Financing needs for inventories and working capital had a broadly neutral impact overall on loan demand.

Demand for loans to households for house purchase dropped not only because of the interest rate level, but also because the housing market prospects continued to deteriorate. The loan rejection ratio rose once again in all loan categories. For the next three months, the surveyed banks are expecting demand for loans to enterprises to continue to fall and demand for loans to households to remain unchanged.

The October survey round contained ad hoc questions on participating banks’ financing conditions and the impact of the key interest rate decisions of the ECB’s Governing Council. It also included questions on the impact of the Eurosystem’s monetary policy asset portfolios and on the third series of targeted longer-term refinancing operations (TLTRO-III).

Against the backdrop of conditions in financial markets, the German banks reported virtually no change in their funding situation compared with the previous quarter. Only access to deposits deteriorated. The Eurosystem’s key interest rate hikes have had, overall, a positive impact on banks’ profitability over the past six months. While they were a drag on net non-interest income, net interest income improved markedly, by contrast. For the next six months, the banks expect the key interest rate decisions to have a far smaller impact on their profitability than in the previous six months. Changes in Eurosystem monetary policy asset portfolios have had barely any effect on banks’ profitability over the past six months. By contrast, the impact on banks’ market financing conditions and liquidity positions was negative. This is likely to reflect the discontinuation of reinvestments of maturing securities under the asset purchase programme (APP) since July 2023. The effects of the TLTRO-III operations on banks’ financial situation continued to peter out over the past six months, with banks reporting a positive impact only on their liquidity position.

The Bank Lending Survey, which is conducted four times a year, took place between 15 September and 2 October 2023. In Germany, 33 banks took part in the survey. The response rate was 100%.