The impact of climate policies on financial markets: Evidence from the EU Carbon Border Adjustment Mechanism Mengjie Shi, Yupu Zhang, Christoph Meinerding

Is climate policy costly for firms? The academic literature has not come up with consistent evidence so far. New research evaluating recent changes in EU legislation suggests that European carbon pricing has finally started to bite.

Climate policy has gained a lot of momentum in recent years, with the EU Emissions Trading System serving as a worldwide flagship. However, existing evidence about the effectiveness of carbon pricing remains inconclusive. In particular, it is unclear how strongly carbon pricing hurts regulated firms and whether there is a tradeoff between financial performance and combating climate change. New empirical Bundesbank research provides clear evidence that recent changes in EU carbon pricing have made this climate policy tool bite. EU climate policy is no longer free of charge for carbon-intensive European firms.

A new era of carbon pricing: The EU Carbon Border Adjustment Mechanism

In December 2023, the EU legislative bodies agreed to introduce a new carbon pricing tool. The EU Carbon Border Adjustment Mechanism (CBAM) represents the world’s first carbon border tax. It narrows an obvious loophole in the current EU carbon pricing scheme. At present, the EU only puts a price on carbon emissions generated within the EU. As of 2026, importers of certain goods will also have to pay a price for carbon emissions generated during the production of these goods outside the EU.

On the research side, economists have found no measurable effect of EU carbon pricing on firms’ financial performance so far. Researchers attribute this to two main factors. First, the EU Emissions Trading System was not stringent enough during its early phases. This has been documented by Dechezlepretre, Nachtigall and Venmans (2023), Colmer, Martin, Muuls and Wagner (2023) or Trinks and Hille (2023), amongst others. Second, researchers face severe challenges when measuring causal effects of climate policy empirically. They often lack proper microdata and do not have enough selective observations at hand to make meaningful causal inference.

The announcement of the CBAM agreement had a negative impact on firms’ stock prices

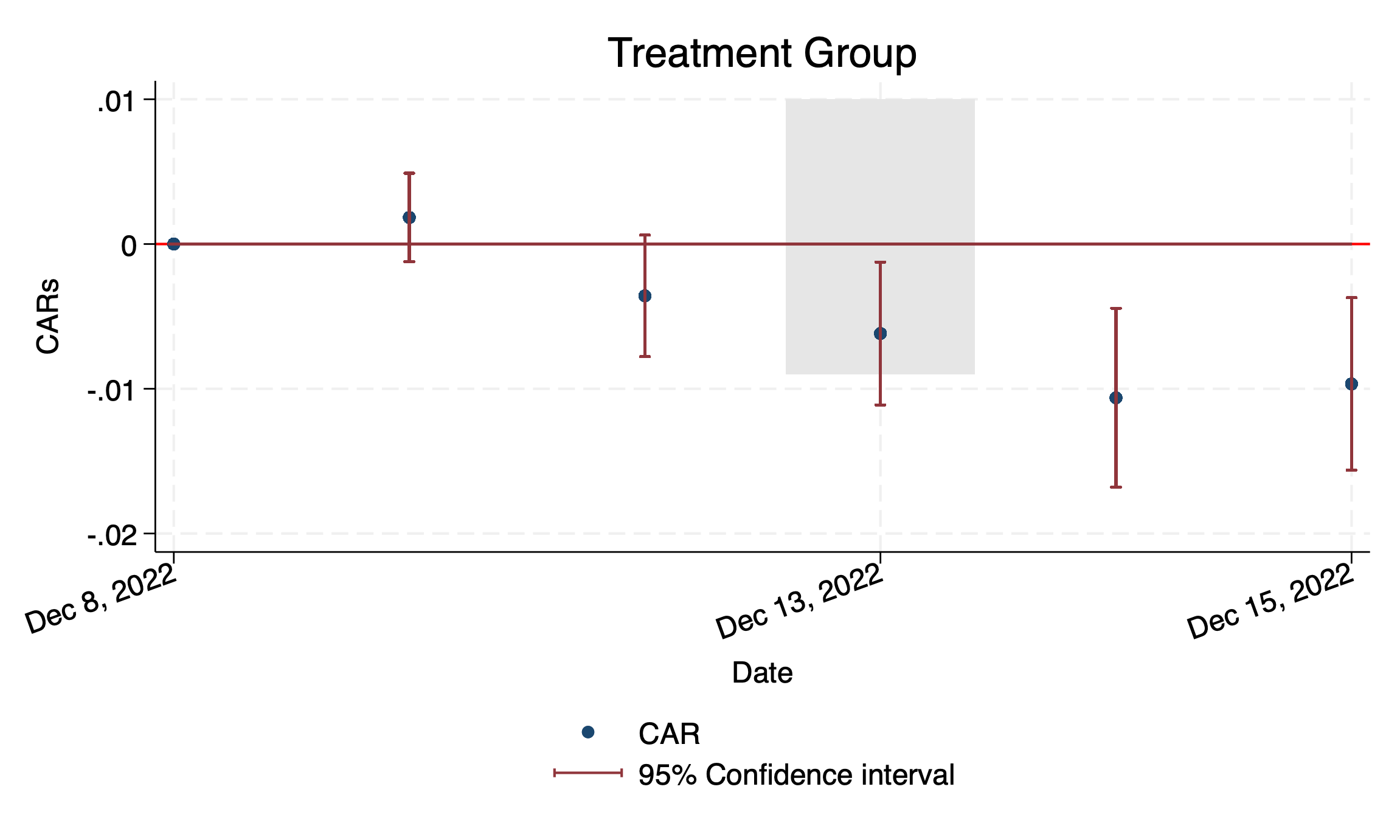

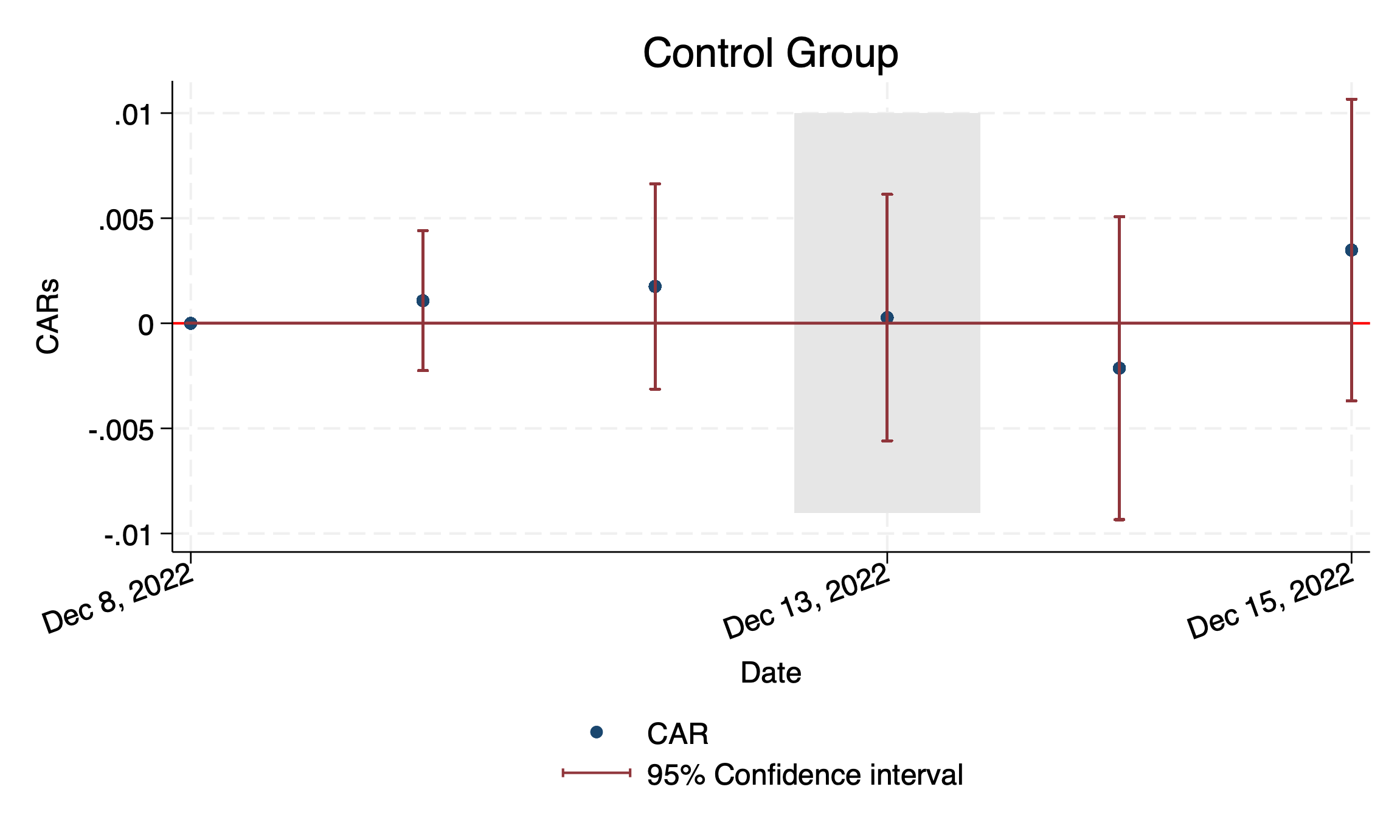

The announcement of the CBAM agreement triggered losses in stock prices of treated firms amounting to about 1.3 percentage points. In a recent Bundesbank discussion paper (Shi, Zhang, Meinerding (2025)), we compare the stock returns of two sets of European firms. Firms that have suppliers in CBAM-affected industries outside the EU are put into the treatment group. Firms that only have suppliers inside the EU and in non-affected industries are put into the control group. Figure 1 shows the cumulative stock returns of these two groups of firms in a short time window around the main event date of 13 December 2022. On this date, the main legislative bodies of the EU reached their decisive agreement concerning the CBAM.

Figure 1: Cumulative abnormal returns of treatment and control group around the announcement date (13 December 2022)

The CBAM agreement also serves as a signal concerning follow-up decisions about EU carbon pricing. In parallel to the CBAM process, the EU negotiated other reforms that further enhance the stringency of the EU Emissions Trading System. For example, the system of free emission allowances that are currently allocated to firms in certain sectors will be phased out gradually. On 13 December 2022, the agreement concerning these other reforms was still outstanding. Yet firms that currently profit from free allowances experienced anticipatory negative stock returns of about one percentage point around this date.

The magnitude of the treatment effect is remarkable, but at the same time not worrisome. First, multiplying the average treatment effect of 1.3 percentage points with the total market capitalisation of all treated firms suggests losses of above €1 billion over the event window. This estimate is roughly in line with EU estimates of the expected CBAM revenues. Second, the documented treatment effect applies to customer firms within the EU, suggesting a spillover of the effects of climate policies along the supply chain. Third, the treatment effect measured here should be regarded as a kind of lower bound for the (unknown) total effect of the CBAM on firms.

Ex-post climate policy evaluation will shape our research agenda going forward

From a broader perspective, these findings represent an example of a large research agenda going forward. A series of climate policy tools have now been implemented and statistical offices collect incoming data on a continuous basis. We are entering a stage where we can evaluate the effectiveness – but also uncover unintended side effects – of existing climate policies empirically ex-post. Causal evidence will enable us to recalibrate climate so as to limit the negative impact on the aggregate economy. In the specific case presented here, recent changes in EU carbon pricing policy had a measurable detrimental effect on the financial performance of regulated firms. At the same time, the magnitude of this effect appears manageable, limiting worries about the prospects of our economy in light of steadily increasing carbon prices.

References

Colmer, J., R. Martin, M. Muuls, and U. Wagner (2023): Does pricing carbon mitigate climate change? Firm-level evidence from the European Union emissions trading scheme, forthcoming: Review of Economic Studies.

Dechezlepretre, A., D. Nachtigall, and F. Venmans (2023): The joint impact of the European Union emissions trading system on carbon emissions and economic performance, Journal of Environmental Economics and Management, 118 (C).

Trinks, A., and E. Hille (2024): Carbon costs and industrial firm performance: Evidence from international microdata.

2 MB, PDF