IBAN rules

General information

Pursuant to Regulation (EU) No 260/2012 of the European Parliament and of the Council of 14 March 2012 establishing technical and business requirements for credit transfers and direct debits in euro and amending Regulation (EC) No 924/2009 (SEPA Regulation), which entered into force on 31 March 2012, since the 1 February 2014 the IBAN (and BIC) is, in principle, to be used to identify payment accounts when making credit transfers and direct debits.

Creating an IBAN in Germany

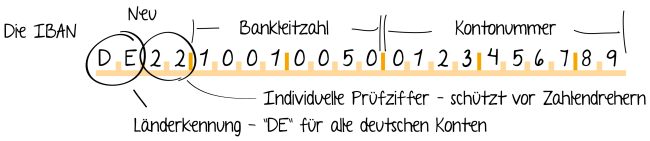

In Germany, the IBAN consists of 22 digits. The first two digits are for the country code ("DE" for Germany) followed by a check digit comprising two characters and the national account number BBAN (basic bank account number), which is made up of the eight-digit bank sort code and the ten-digit account number. Shorter account numbers are generally left-justified and preceding zeros are added to make them up to ten digits.

As some payment service providers apply institution-specific features when converting their account numbers and bank sort codes to IBAN (and BIC) in terms of how they structure their national BBAN, the central associations of the German banking industry and the Deutsche Bundesbank have agreed that all payment service providers with a bank sort code must abide by an agreement on IBAN rules requiring them to disclose the calculation method they use to create the IBAN (and BIC) for their payment accounts from the account number and bank sort code. Each calculation method (IBAN rule) is assigned a code which is entered in a new field in the extended bank sort code file. This code can be used to identify the corresponding IBAN rule in the overview. An IBAN rule applies to all accounts managed under a particular bank sort code; it can contain different provisions for various groups of account numbers.

Overview of IBAN rules

The German banking industry has predefined two IBAN rules (standard IBAN rule and no IBAN identification). If a payment services provider uses a different IBAN rule from one of these, this must be reported to the Bundesbank, if applicable via the relevant central authority or association. The predefined IBAN rules and those that have been reported are listed in an overview of IBAN rules.

Changes to IBAN rules or new IBAN rules are only entered in the overview of IBAN rules if they are approved by the Bundesbank two months prior to the corresponding validity date of the bank sort code file. As they are linked with the extended bank sort code file, IBAN rules only come into force on the validity dates on the Monday after the first Saturday of the month in March, June, September and December. The report must contain an exact description of the IBAN rule as well as the contact details of one contact person (preferably a functional e-mail address) and is to be submitted to the office of the Bundesbank which carries the account.

The Bundesbank assigns each IBAN rule a four-digit code and a two-digit version number beginning with "00" which is then increased in ascending numerical order every time the IBAN rule is modified.

The predefined standard IBAN rule has the code "0000 00" and the predefined no IBAN identification rule has the code "0001 00".

The Bundesbank publishes an up-to-date overview of the IBAN rules (as a pdf document) on the Next-platform of the Deutsche Bundesbank two months before the respective validity date of the bank sort code file.

The IBAN rules were introduced because of SEPA in order to convert the master data (convert the account number and bank sort code to the IBAN). From 21 November 2016 their main function will be to collect cheque forms which still contain the account number and the bank sort code. As of this date cheques can only be collected using the IBAN, which must also be specified on the cheque forms; however, cheque forms produced before this date which contain the account number and bank sort code may still be used until further notice. The IBAN rules will be used when collecting such cheque forms containing the account number and bank sort code.

Bank sort code file

In the bank sort code file, every bank sort code is assigned an IBAN rule. To this end, the bank sort code file was extended in June 2013 to include a new six-digit field (4 digits for the code and two digits for the version number): field 14 "Code for the IBAN rule". This field contains the code that is assigned to the relevant IBAN rule.

In order to minimise the need for adjustment on the part of users of the bank sort code file, the file is provided in two versions: an unchanged version and an extended version including the new codes. The extended version is published on the Next-platform of the Deutsche Bundesbank only.

Publication on the Next-platform of the Deutsche Bundesbank

All interested market participants (only legal entities)– in addition to payment service providers, this may also include providers of software products for example – can access the extended bank sort code file and the overview of IBAN rules via a secure download from the Next-platform of the Deutsche Bundesbank.

Users who are not yet registered to access the bank sort code file from the Next-platform of the Deutsche Bundesbank should send a registration request containing their name, address and telephone number via e-mail to the following address: routing(at)bundesbank.de.