Transaction values External Transactions

The transaction values data are available exclusively as direct FDI data. This means that the data can only show direct holdings of more than 10 % in affiliated enterprises. It is not possible to collect data on direct investment chains.

Asset/liability principle

Data can be presented based on one of two principles. When applying the asset/liability prin-ciple (ALP), FDI assets and liabilities are reported in gross terms. This principle is consistent with the international requirements for compiling the balance of payments and the stock sta-tistics for the international investment position.

Extended directional principle

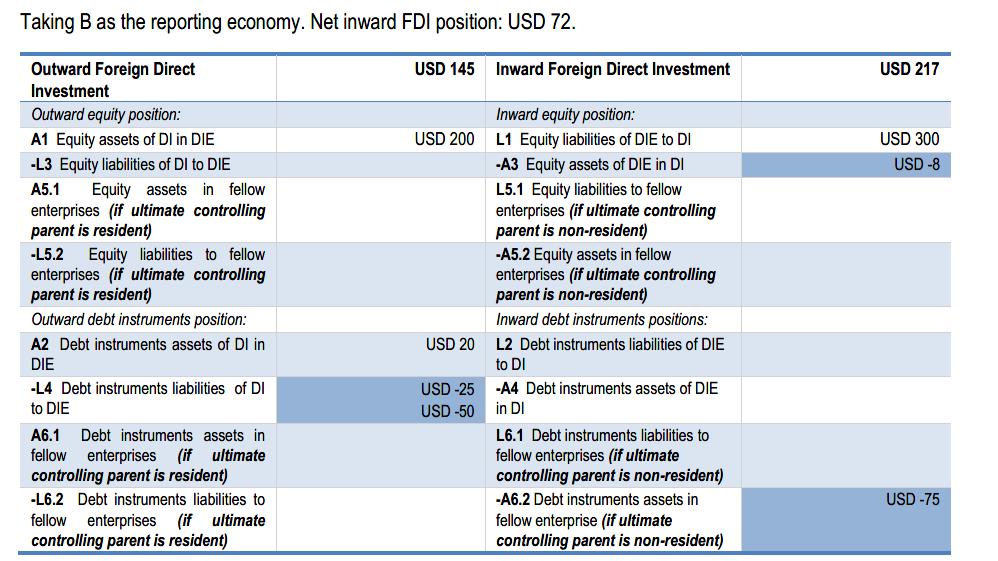

Unlike the traditional comparison of assets and liabilities, the extended directional principle (xDP) takes into account capital links in the FDI relationship. Thus, reverse investments, where a direct investment enterprise provides funds to the direct investor, are deducted and links between fellow enterprises are also taken into account. These inter-company loans are assigned to a direction based on where group headquarters are resident. If the group’s head-quarters are in Germany, all credit positions between resident and non-resident fellow enter-prises are recorded as outward foreign direct investment by Germany. Conversely, for group headquarters located abroad, those positions are recorded as inward FDI in Germany.

-

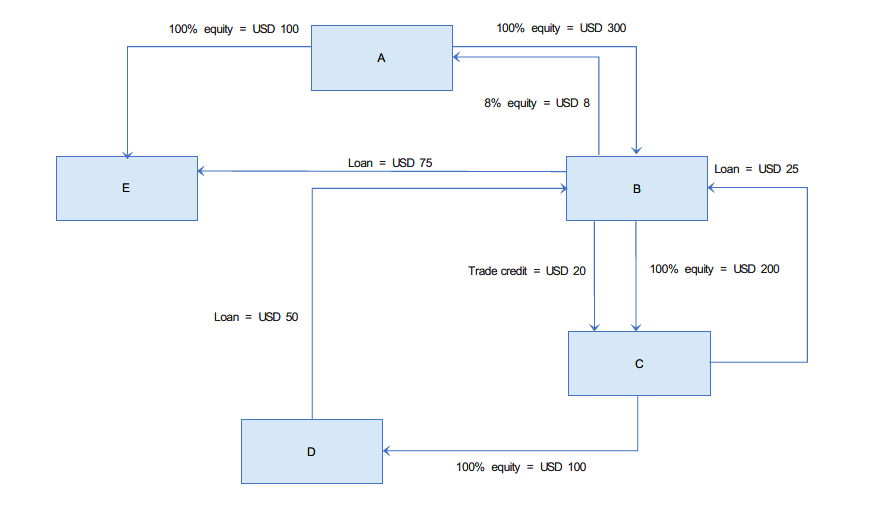

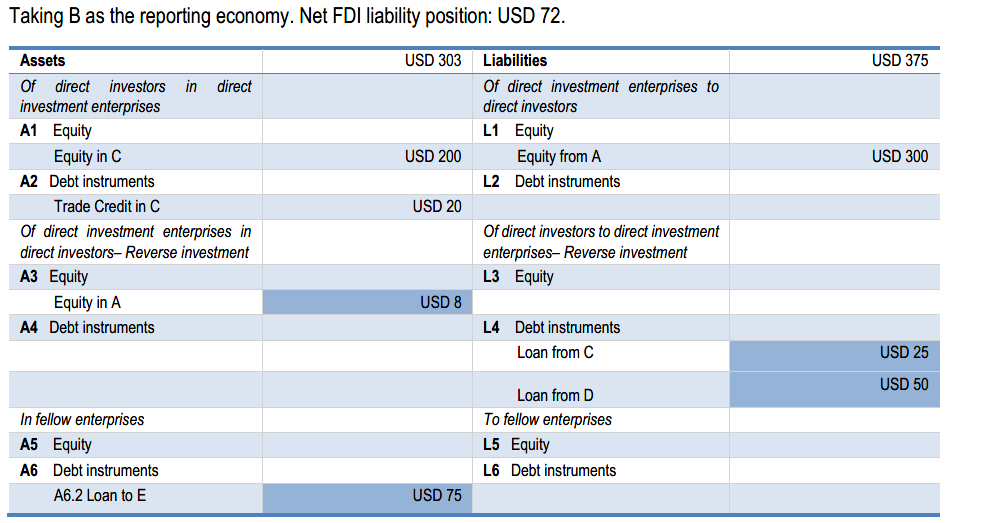

To illustrate the principles, consider this fictional FDI relationship with enterprise A as the group parent. All enterprises are assumed to be located in different countries. The group structures are as follows:

According to the ALP, from the perspective of enterprise B, all claims on affiliated enterprises (200 MU equity investment in C, 20 MU trade credits to C, 8 MU equity investment in A) = 228 MU, plus all claims on fellow enterprises (75 MU loans to E) = 75 MU are added up (= 303 MU) and netted against the sum of liabilities derived in the same way (375 MU). In net terms, 72 MU of outward FDI are recorded (see below).

Under the xDP, equity and debt positions of the direct investment enterprise (enterprise B) and the direct investor (enterprise A) are netted. Reverse investments are therefore taken into account. At the same time, it is also clear in this case that, depending on the country in which group headquarters are located (whether in Germany or abroad), the positions of fellow en-terprises must also be taken into account.