Monthly Report: When insurees retire and how pension benefit reductions and increases could be determined

Population developments are putting considerable pressure on the German labour market and government finances. There are more and more pensioners but fewer and fewer people paying into the statutory pension insurance scheme. How much of a burden this becomes will depend on how long people work in old age and when they retire. The higher the level of employment, the greater the growth potential. Revenue from taxes and social contributions also increases. This eases the strain on government finances and social security funds. The design of the statutory pension insurance scheme plays a particularly important role in the decision when to retire.

Minimum retirement ages in the pension insurance scheme are crucial

The Monthly Report explains the main variables that determine when people retire. These are the statutory retirement age, the minimum age for early retirement without benefit reductions, and the earliest possible early retirement age.

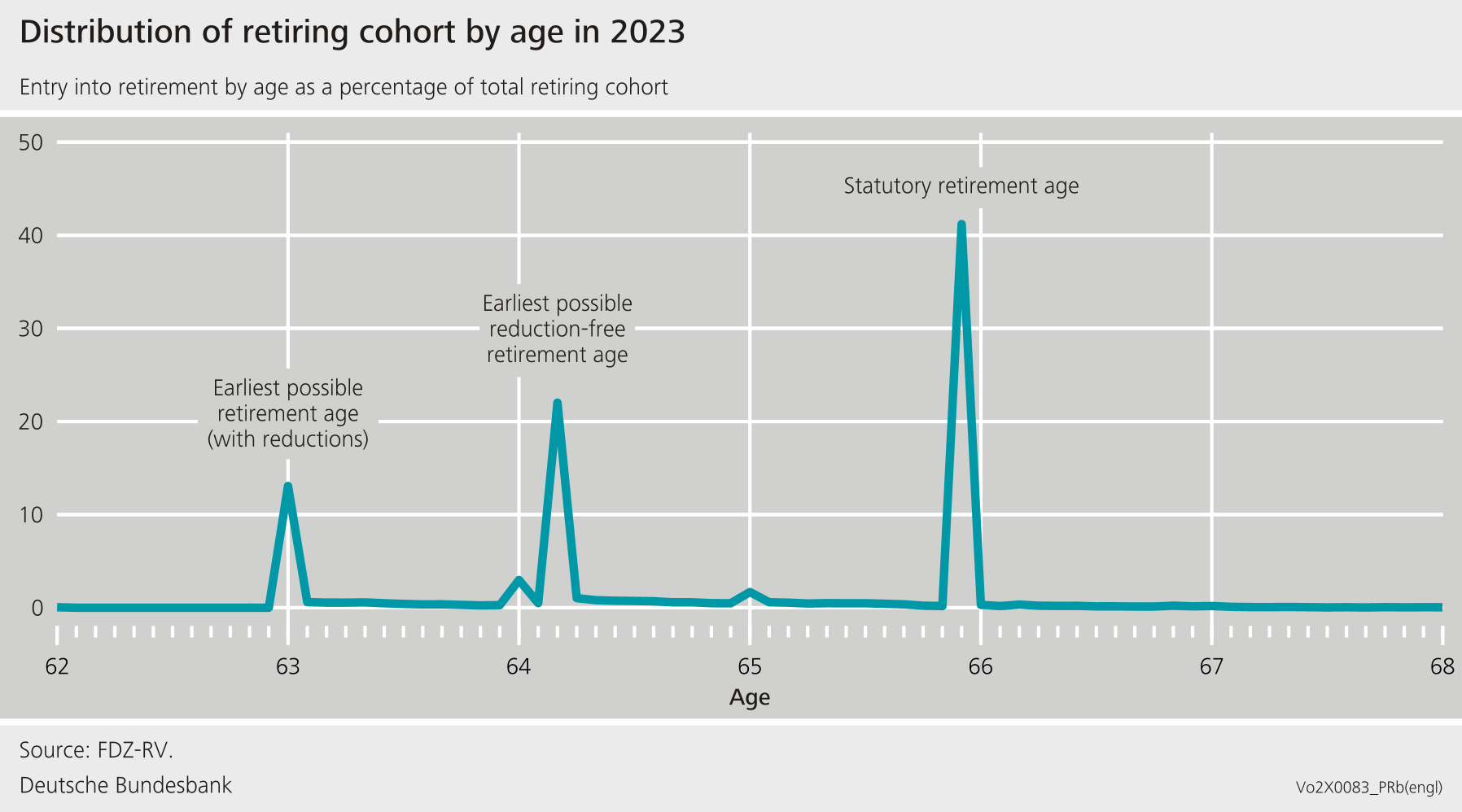

- The statutory retirement age is the key point of reference for retirement. Most insurees apply for their old-age pension at this point in time. In 2023, this accounted for around 40 % of new pensioners.

Many insurees retire earlier, however. For most people, the main consideration is when they can retire without any reductions to their pension benefit. People with a particularly long period of insurance can retire early with no benefit reductions after being insured for 45 years.

- Some insurees are willing to accept benefit reductions. They usually retire as early as possible, which is from the age of 63.

Only a small number of insurees work beyond the statutory retirement age. They then receive increases in their pension entitlement.

The Bundesbank’s economists consider it particularly important to review the minimum retirement ages in the pension scheme given the demographic challenges. The Bundesbank had already outlined these ideas in more detail in previous Monthly Reports (most recently in the August 2019 and June 2022 editions). These considerations match up with the recommendations of many institutions and advisory bodies. These include those given in the current Economic Survey of Germany by the Organisation for Economic Co-operation and Development (OECD) and the 2023‑24 Annual Report of the German Council of Economic Experts.

Link retirement age to life expectancy after 2031 and end preferential treatment

To extend working lives, it is important to adjust the statutory retirement age to rising life expectancy after 2031 as well, the economists write in the report. Otherwise, the length of the employment period will keep shrinking in relation to the length of retirement. With life expectancy rising, there is much to be said for adjusting the minimum retirement age as well. The minimum age for the earliest possible point at which employees can retire could also be linked to developments in life expectancy.

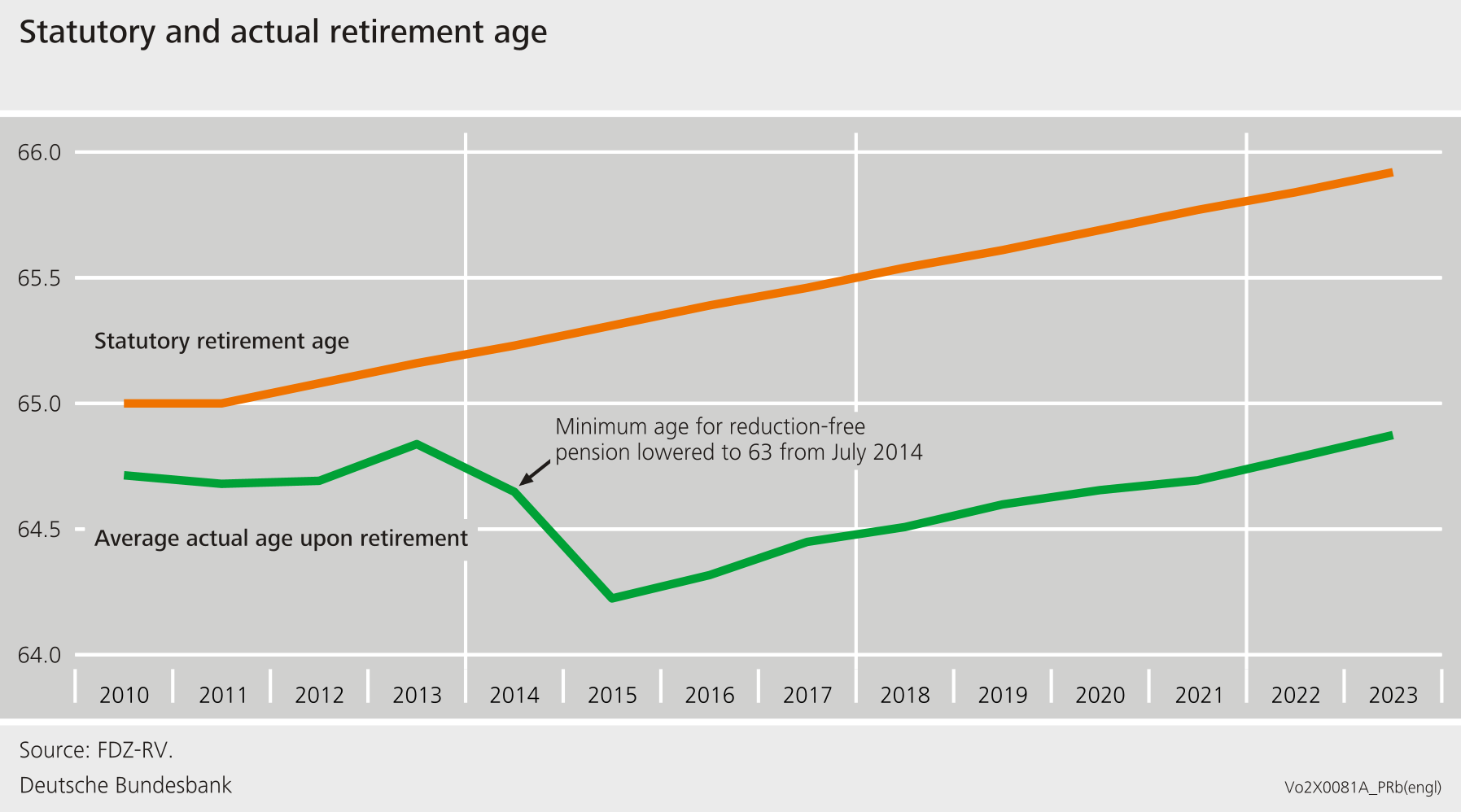

In addition, the authors suggest that, in view of the demographic challenges, it would also make sense to scrap the early reduction-free pension. This rule constitutes preferential treatment. It means that the contribution payments of people receiving the reduction-free pension are more heavily weighted than those of non-recipients. The rule has thus led to a significant decline in the average actual age at retirement.

Standard approach suggests that current reductions are too low and increases too high

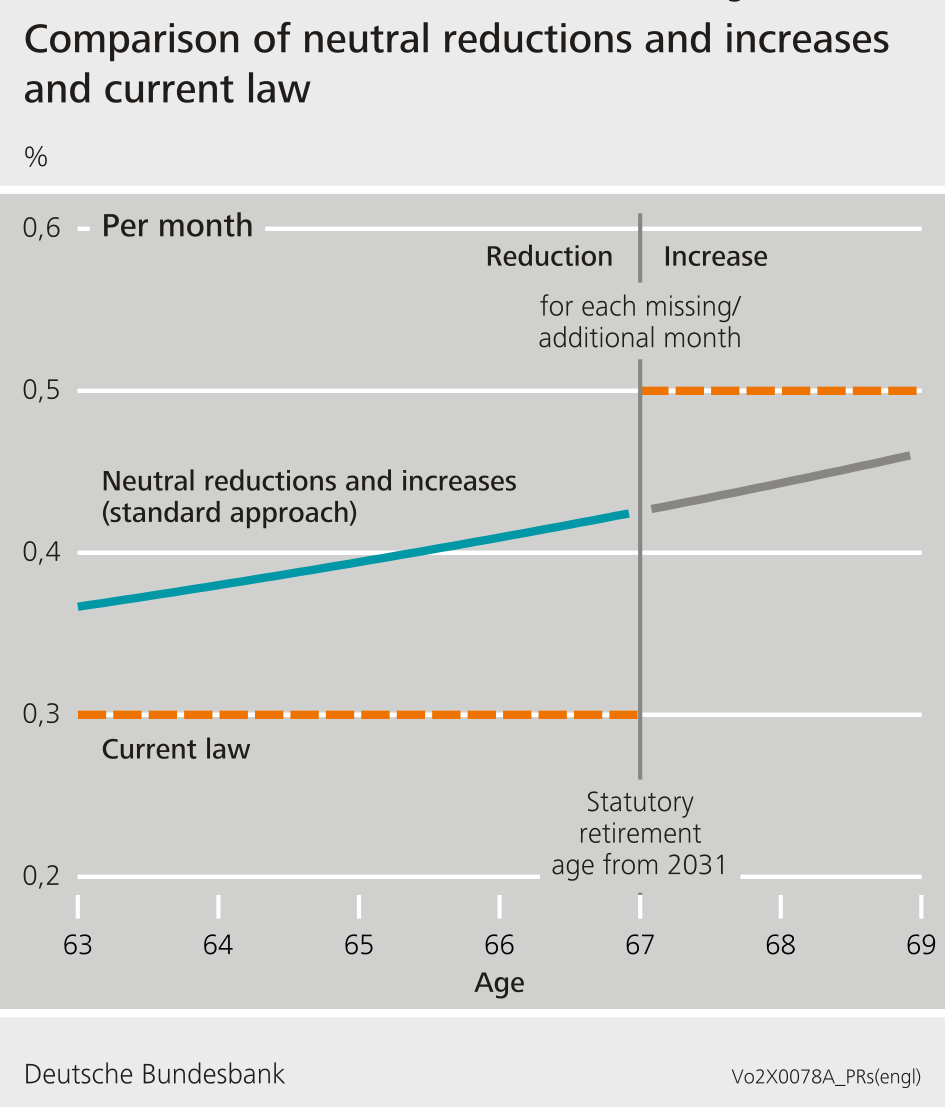

Reductions and increases for early or late retirement are important when it comes to entering retirement. The Bundesbank’s economists urge that these be determined based on clear and understandable principles. One way to do this is to use an actuarial approach, which is explained in the report. This approach is based on methods that are common in the literature. The aim is to determine reductions and increases that are financially neutral from the perspective of an insuree with an average lifespan.

The calculations suggest that the current reductions make it financially attractive for insurees to retire earlier. This puts a strain on the pension insurance scheme. The authors argue that the standard calculations therefore show that benefit reductions should be raised and increases should tend to be lowered in the pension insurance scheme. There is also much to suggest that reductions and increases in retirement benefits should be staggered according to distance from the statutory retirement age in order to make them neutral.

Regularly review benefit reductions and increases based on clear and transparent methods

The Monthly Report urges for reductions and increases to be determined in a clear and transparent way, reviewed regularly and adjusted if necessary. This could be done every five years or whenever the Federal Statistical Office publishes new population projections. Any changes would then affect future retirement cohorts. Since being introduced in 1992, however, the current reductions and increases have not been adjusted, even though framework conditions have changed substantially since then.

Complete article

Further information

in German only