Insights into German direct investment statistics

Development of foreign direct investment (FDI) in Germany by ultimate investing economy (UIE) between 2011 and 2023

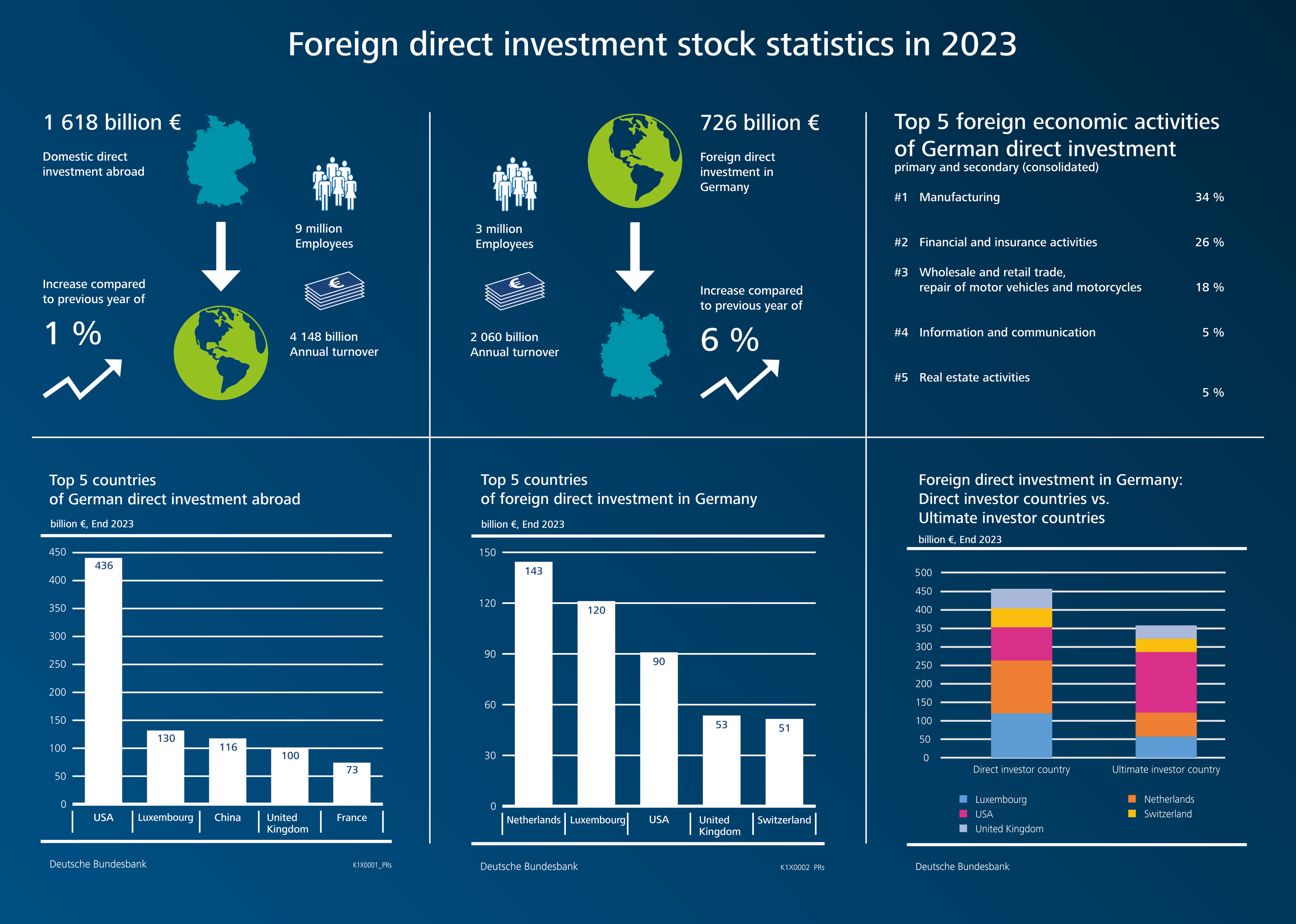

When considering foreign investment in Germany by the country of the immediate investor, the largest shares typically originate from the Netherlands and Luxembourg. These are primarily holding locations through which capital is routed. An analysis of FDI stocks by ultimate investing economy (UIE) enables the allocation of investments to the country where the group’s headquarters are located, and thus to the country where investment decisions are ultimately made. This approach can significantly shift the regional distribution of capital providers, and Germany itself appears as a source country for investments.

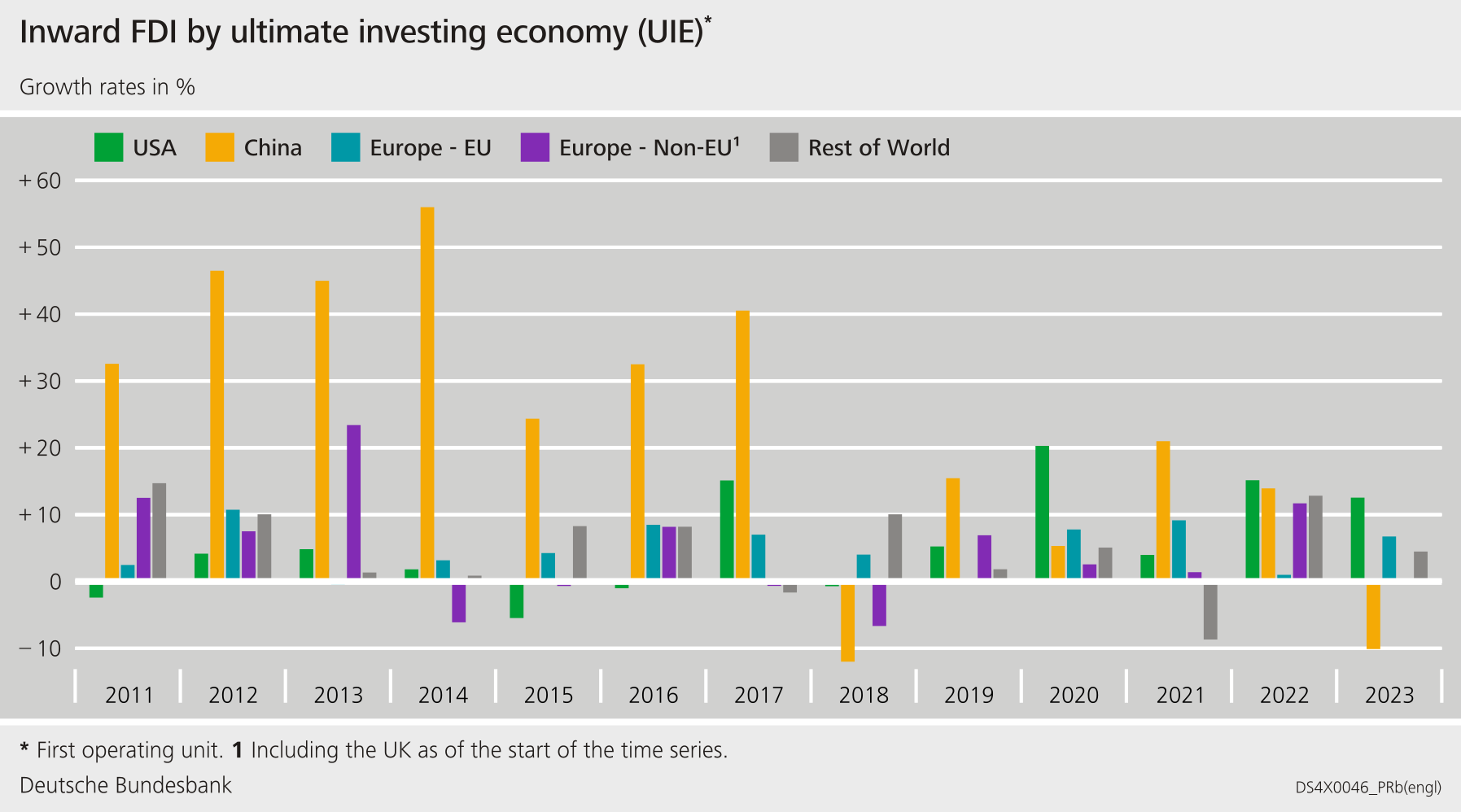

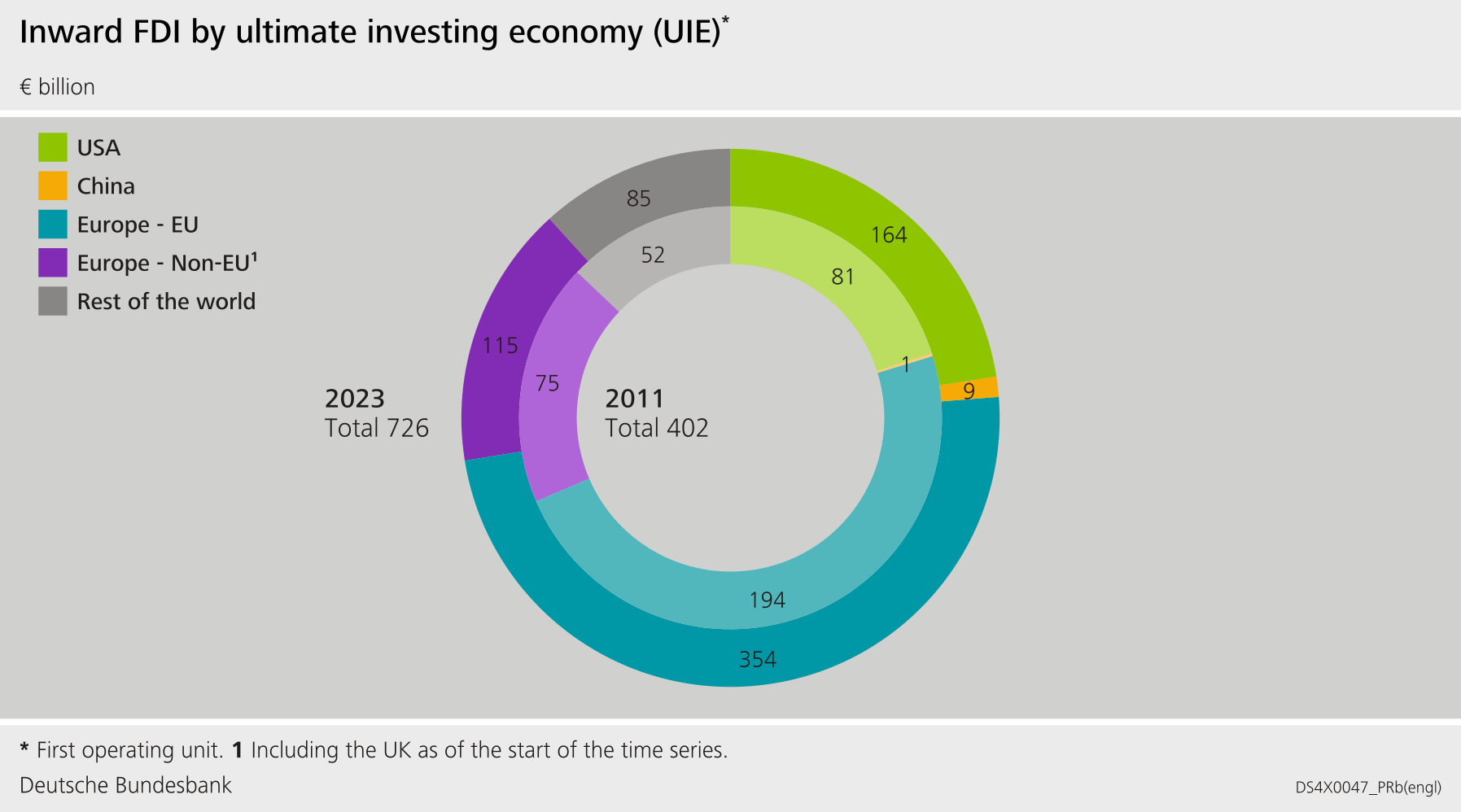

The following overview shows the development of the stocks of the first operational unit in Germany by UIE, as well as the corresponding growth rates. Data for both are available from 2011 onwards. Over this period, FDI in Germany, measured by UIE, increased by 80 %, rising from around €400 billion to over €700 billion. This growth was driven by new investments, reinvested earnings, market price effects, and loans.

Individual countries and regions contributed to this growth to varying degrees. The development of direct investment from companies with Chinese headquarters was particularly dynamic: in the first seven years of the period under review, annual growth rates ranged between 25 % and 55 %, before slowing markedly from 2018 onwards.

There are essentially two reasons for this: first, the starting level in 2011 was comparatively low, at around €1 billion, so that additional investment volumes generated high growth rates. By the end of 2017, Chinese FDI stocks in Germany had already reached nearly €7 billion. Second, since the beginning of the last decade, China has increasingly invested in foreign key technologies in an effort to secure access to future markets.

By the end of the observation period, the stocks of companies with Chinese headquarters had risen to around €9 billion. In terms of the share of Chinese investment in total FDI stocks, holdings by Chinese parent companies accounted for just 1 % of all FDI in Germany at the end of 2023, despite having increased almost tenfold since 2011.

The picture is different for investments from companies with headquarters in the EU and other European countries. In 2011, these accounted for over two-thirds of all FDI in Germany, at around €270 billion. By 2023, FDI stocks from these countries had increased by more than 80 % for the EU and by over 50 % for other European countries. This growth was noticeably lower than for companies with headquarters outside Europe (+ 90 %). Accordingly, Europe’s share of FDI in Germany declined slightly, but remained dominant at just under 65 % and around €470 billion.

The strong increase in non-European investment was primarily attributable to companies with headquarters in the United States. Since 2011, these have more than doubled their investment in Germany. In 2023, they accounted for around €160 billion, or just under a quarter of all direct investment, representing a slightly higher share than in 2011 (20 %). By contrast, the share of the rest of the world declined slightly from 13 % to 12 %, corresponding to a stock of around €90 billion in 2023 compared to around €50 billion in 2011.

Germany’s foreign direct investment stocks at the end of 2023