Banks trust other banks Information about Bundes-Bank. In easy-to-read format.

You want to take money out of the bank.

You take your card to the cash machine.

You put your card in the slot.

Then you type in your PIN number.

The money comes out of the machine.

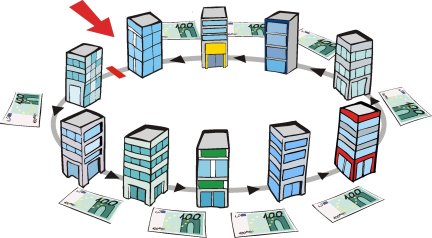

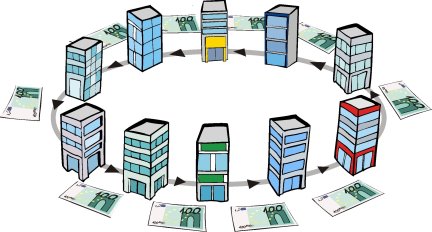

Your bank might have borrowed this money from another bank. Banks lend each other money. Interbank market is another name for this exchange of money from one bank to another.

As long as banks lend money to each other, the interbank market works well.

The difficult word for this is financial stability.

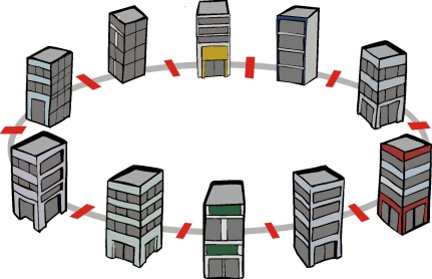

If a bank has made mistakes, it might not be able to lend other banks any money.

Because it does not have any money of its own.

The other banks notice this.

They no longer trust each other and stop lending each other money.

Money stops moving between the banks.

This is why the Bundesbank checks whether the banks have enough money.

This is what the Bundesbank does:

Inspectors from the Bundesbank go into the banks.

The inspectors check the bank’s records.

The difficult name for these documents is balance sheet.

The inspectors from the Bundesbank notice if people in the bank have made mistakes and the bank does not have enough money of its own.

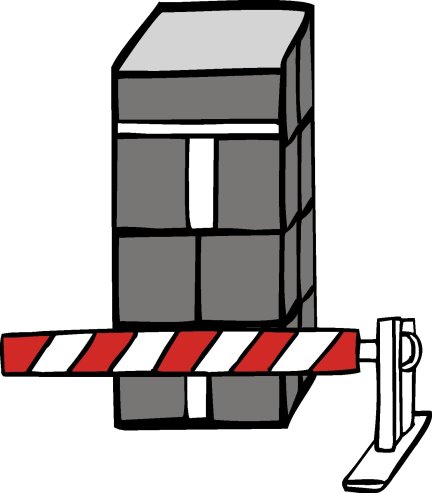

Then the Bundesbank might close the bank.

The banks trust the Bundesbank to close any banks that have made mistakes.

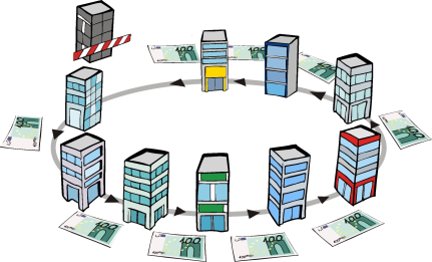

Then the banks trust each other again. They lend each other money.

There is financial stability.

The Bundesbank does not work alone to make sure that the banks trust each other.

It works with lots of other people in lots of other countries.

The Bundesbank works in the Basel Committee at the BIS. BIS is the short name for Bank for International Settlements.

The Bundesbank works together with the ESRB.

This is the short name for European Systemic Risk Board.

The Bundesbank works in the Financial Stability Board.

Illustrations: © Reinhild Kassing