Making rules for banks Information about Bundes-Bank. In easy-to-read format.

There are lots of banks in Germany.

About banks with thousands of branches.

You can see their buildings in town.

Here you can see a few bank buildings.

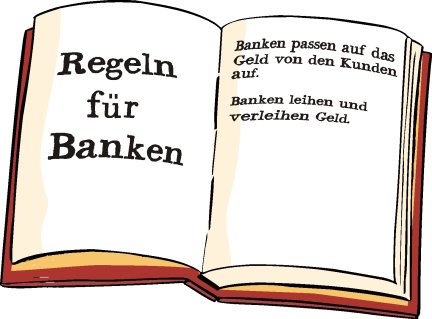

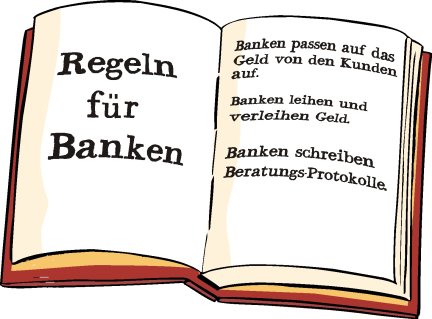

The Bundesbank makes rules for these banks.

A rule is part of a law.

The Bundesbank also checks that the banks follow these rules.

This is also called banking supervision.

In other words, the Bundesbank supervises banks.

The Bundesbank does not do this on its own.

It works with BaFin.

BaFin is the short name for the German Federal Financial Supervisory Authority.

And together with the ECB from 2014 onwards.

The ECB is the short name for the European Central Bank.

The Bundesbank, the ECB and BaFin make rules for the banks together.

One of the rules tells banks how much money they must have in order to be allowed to lend money.

This is important for you if you want to borrow money.

For example, a bank lends money to people if they want to buy a house.

But a house is very expensive.

That is why these people might not have enough money at the moment.

They cannot buy a house.

The people go to the bank.

The bank gives the people advice.

If people earn enough money, the bank lends them money.

This is called a loan.

But the money is not a gift.

The people have to pay the money back to the bank later on.

The people even pay extra money back to the bank.

It costs money to borrow money.

This cost is called: interest.

The bank must always have enough of its own money to be able to lend money to people.

Otherwise people cannot borrow money.

The people would not be able to buy a house.

The Bundesbank and Bafin check that the banks in Germany follow the rules.

This is what the Bundesbank does to check on the banks: Inspectors from the Bundesbank go into the banks.

The inspectors check the bank’s records.

The difficult name for these documents is balance sheet.

Perhaps people in the bank have made mistakes.

They have perhaps done business where money can be lost. And then lost too much money.

Then the bank does not have enough money to lend to people.

The inspectors from the Bundesbank notice this.

The Bundesbank might then create a new rule.

Then this rule applies to all the banks.

Illustrations: © Reinhild Kassing