Acquisition of financial assets and external financing in Germany in the second quarter of 2021 Results of the financial accounts by sector

Households’ financial assets continue to rise

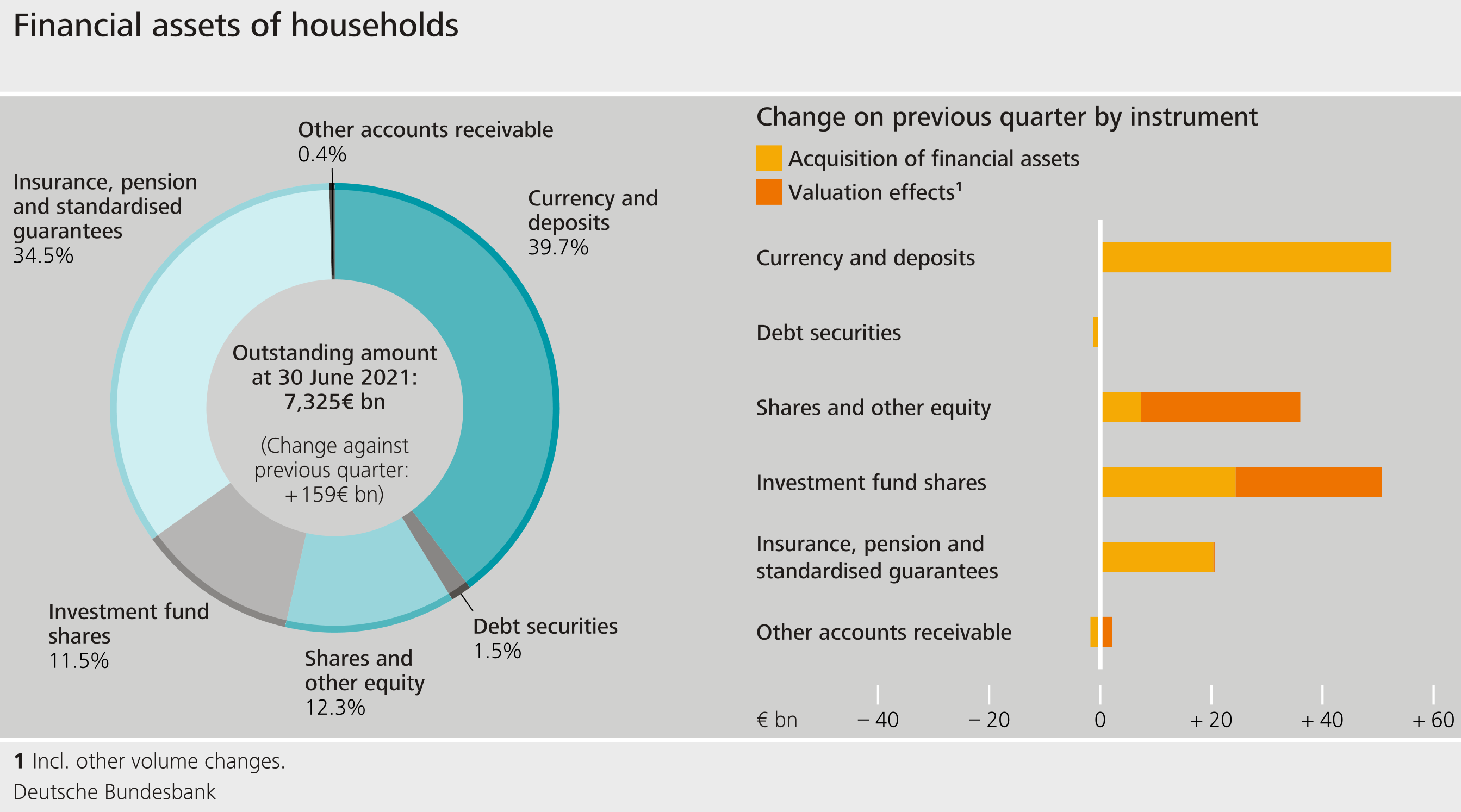

Households’ financial assets grew by €159 billion to €7,325 billion in the second quarter of 2021. Alongside the transaction-related increase in financial assets (acquisition of financial assets), valuation gains on shares and investment fund shares played a significant role.

At €101 billion on balance, households’ acquisition of financial assets was roughly the average of the past four quarters. Around half of this is attributable to currency and deposits rising strongly again. Claims on insurance corporations were raised by only around €20 billion, slightly less than in previous quarters. Liquid investments or forms of investment that are perceived to be low-risk are still very popular on the whole, but households’ capital market exposure has followed an upward trend for a number of years. In the reporting quarter, households purchased investment fund shares worth €24 billion and shares for another €7 billion. Only in the case of debt securities did sales and redemptions exceed purchases, by around €1 billion, which reduced holdings by households further, as in previous quarters. The valuation-related increase in financial assets of €57 billion in the second quarter of 2021 was mainly driven by price gains on shares and investment fund shares.

At €29 billion, household debt was up relatively strongly over the course of the quarter, leaving liabilities at €1,989 at the end of the quarter. However, with aggregate economic activity increasing markedly at the same time, the household debt ratio was in decline overall and stood at 57.8% at last report. The debt ratio is defined as total liabilities as a percentage of nominal gross domestic product (four-quarter moving sum).

Households’ net financial assets closed the second quarter at €5,336 billion.

External financing of non-financial corporations still very dynamic

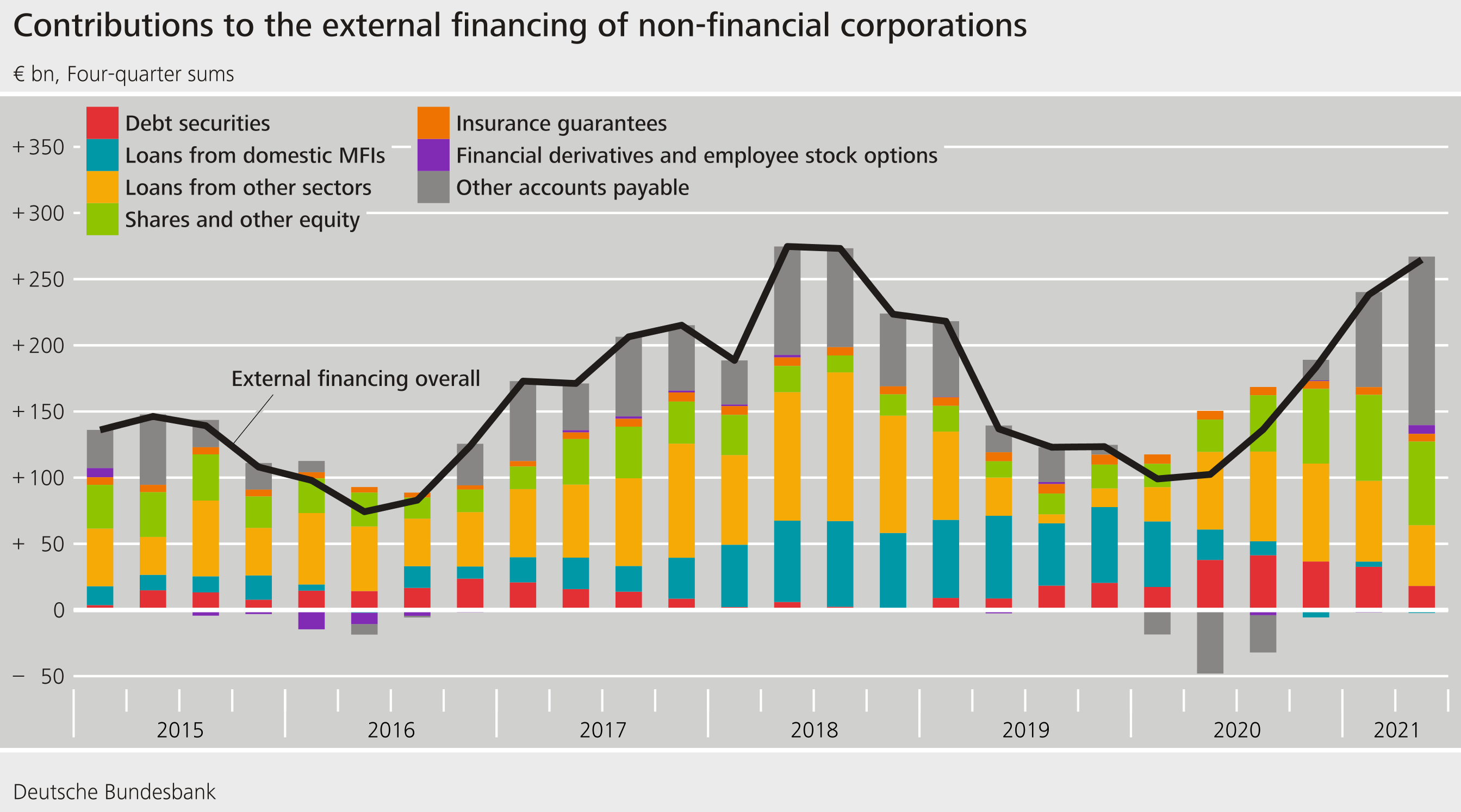

External financing of non-financial corporations remained strong by amounting to €44 billion during the quarter. After loans and other accounts receivable had dominated external financing in the previous quarters, non-financial corporations drew on a more balanced financing mix in the reporting quarter. By issuing debt securities, as well as by taking up loans, corporations received €9 billion, respectively. They primarily took up loans vis-à-vis non-resident creditors and in form of assistance loans granted by government. Credit liabilities with banks, however, were reduced on balance. By issuing shares and other equity, non-financial corporations attracted another €8 billion. Other accounts payable, an item that includes trade credits and advances, rose by €11 billion.

From an annual perspective, external financing has followed a pronounced upward trend. This was largely due to an increase in other liabilities. In addition, the contributions of shares and other equity to external financing were relatively high, whereas the importance of funds raised through loans has been diminishing for some time now.

Both the dynamics described above and the pronounced valuation effects drove up non-financial corporations’ liabilities again significantly to €7,837 billion at the end of the second quarter of 2021. Non-financial corporations’ debt ratio, calculated as the sum of loans, debt securities and pension provisions as a percentage of nominal gross domestic product (four-quarter moving sum) declined to 80.6%, however, due to the strong rise in GDP compared with the previous quarter.

Financial assets of non-financial corporations grew by €72 billion in the previous quarter, amounting to €5,663 billion at the end of the quarter. Only a tenth of this increase is attributable to transaction-related financial asset acquisition; the remainder is dominated by valuation gains on shares and investment fund shares.

As liabilities rose more sharply than financial assets, net financial assets fell to the current level of -€2,174 billion.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.

Annexes: Tables