Acquisition of financial assets and external financing in Germany in the third quarter of 2021 Results of the financial accounts by sector

Growth in households’ financial assets slows

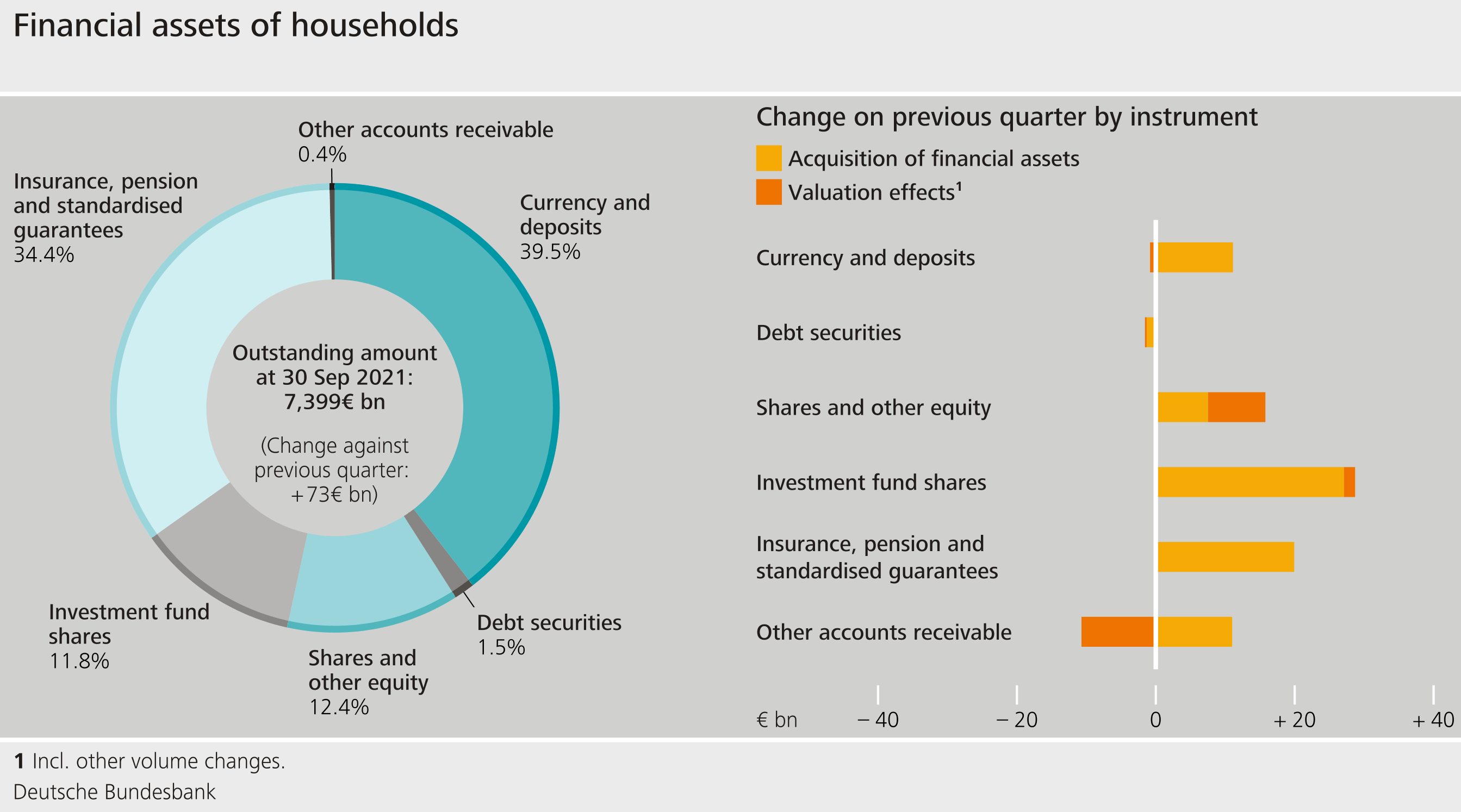

Households’ financial assets grew by €73 billion to €7,399 billion in the third quarter of 2021. Growth was thus markedly weaker in comparison to the previous quarters, taking into account all transactions and valuation changes.

Of particular note here are the valuation gains on shares (€8 billion) and investment fund shares (€2 billion), which were considerably smaller than in the second quarter of 2021 (€26 billion in each case).

Currency and deposits were topped up by just €11 billion, the smallest amount since 2016. This is likely, in part, to be the result of a partial normalisation in the third quarter of 2021 of the pandemic-related increase in saving by households. In the case of debt securities, sales and redemptions exceeded purchases once again by roughly €1 billion. The acquisition of financial assets was somewhat more dynamic when it came to the other instruments. Much the same as in the previous quarter, claims on insurance corporations increased by roughly €20 billion as a result of transactions. Households purchased €27 billion worth of shares in investment funds, which was actually slightly more than in the previous quarter.

Households’ liabilities once again grew relatvely sharply, by €31 billion to €2,020 billion –thus exceeding the €2 trillion mark for the first time. However, as aggregate economic activity picked up at the same time, the household debt ratio remained nearly unchanged overall at 57.6%. The debt ratio is defined as total liabilities as a percentage of nominal gross domestic product (GDP) (four-quarter moving sum).

Households’ net financial assets closed the third quarter at €5,379 billion.

Issuance of shares and other equity continues to gain in importance for the financing of non-financial corporations

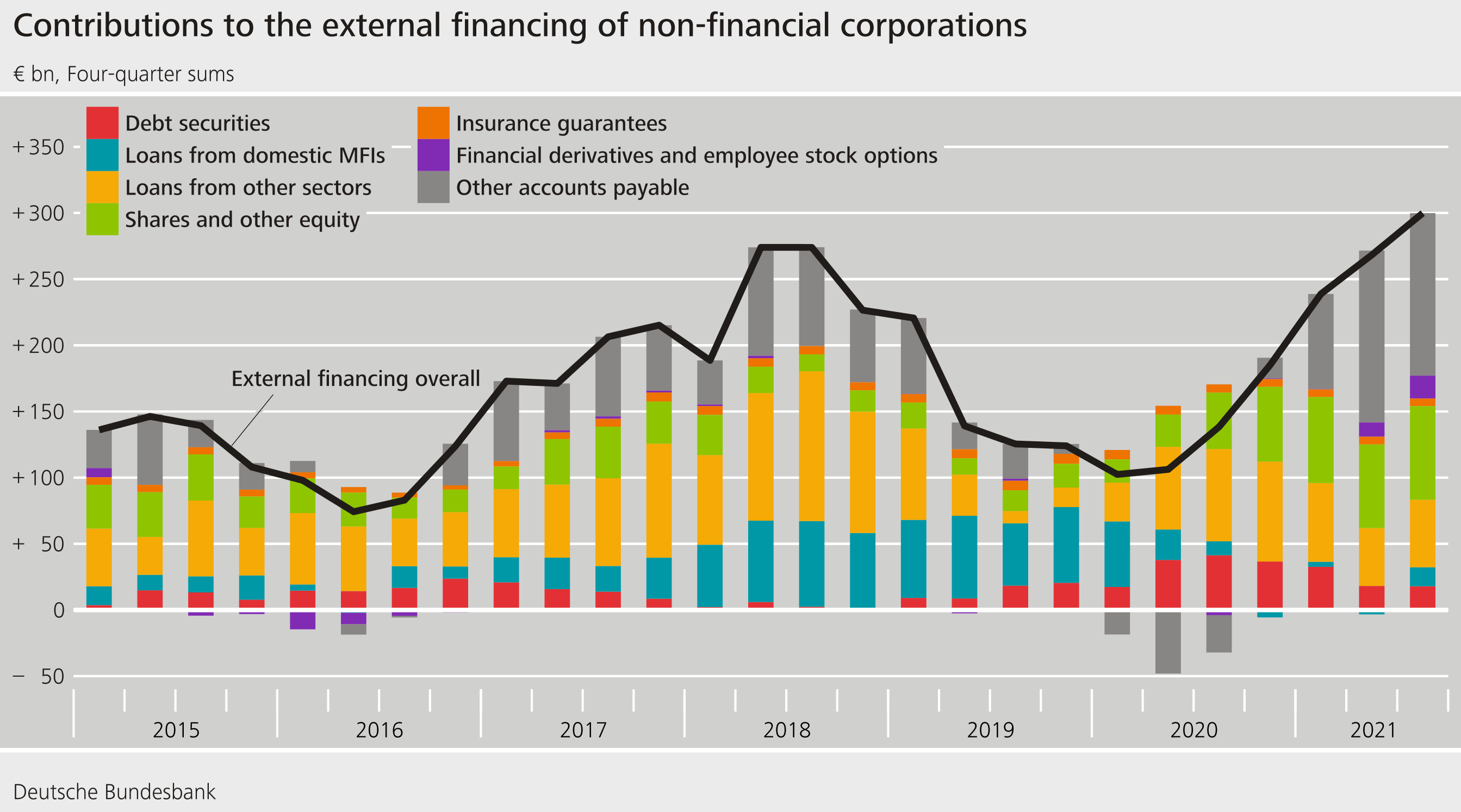

At €105 billion, net external financing of non-financial corporations was well above the average of the previous quarters. The latest rise is attributable first and foremost to the high issuance volume of shares and other equity, which at a total of €29 billion reached its highest level in 20 years. This could indicate that enterprises which had to run up a larger amount of debt as a result of the pandemic want to strengthen their capital base again and thus their resilience to future crises. Extensive recourse also continued to be made to debt financing. Enterprises received inflows of €10 billion through the issuance of debt securities. At the same time, they borrowed funds in the amount of €24 billion, which was primarily provided by foreign non-banks. Borrowing from domestic banks was fairly low at €3 billion, but, unlike in previous quarters, this nevertheless made a positive contribution to external financing. Enterprises obtained a further €33 billion of financing via other accounts payable, which mainly comprise trade credits and advances.

In annual terms (four-quarter moving sums), the upward trend in external financing became more firmly established. Since mid-2019, this development has mainly been due to shares and other equity. In this perspective, financing via bank loans also picked up some momentum again, while financing via debt securities has recently remained comparatively stable.

Over the course of the quarter, the liabilities of non-financial corporations exceeded the €8 trillion mark for the first time, standing at €8,063 billion at the end of the third quarter of 2021. However, due to the strong rise in GDP, the debt ratio declined by 0.7 percentage point on the quarter to 81.2%. The debt ratio is calculated as the sum of loans, debt securities and pension provisions as a percentage of nominal GDP (four-quarter moving sum).

Financial assets of non-financial corporations grew by €189 billion in the third quarter, amounting to €5,836 billion at the quarter’s end. Of this, €81 billion was attributable to the transaction-related acquisition of financial assets. In the third quarter, valuation gains on claims from financial derivatives, which were driven primarily by rising energy prices, also contributed to the rise in financial assets to a considerable extent. However, similar valuation changes were also observed on the non-financial corporations’ liabilities side, meaning that the net effect for the corporations is negligible. Overall, therefore, non-financial corporations’ net financial assets rose only marginally to -€2,227 billion.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.