amplus

amplus (Latin for wide, spacious, big.) is a concept developed by the Bundesbank for improving small-value cross-border payments between individuals – a concept to supplement established cross-border payment solutions that is designed to make credit transfers to individuals (remittances) more efficient in low and middle-income countries.

Current situation

In Europe, great progress has been made with regard to the transparency and speed of cross-border payments in recent years. One key achievement in this regard is TIPS (TARGET Instant Payment Settlement) – a service offered by the Eurosystem for the real-time settlement of instant payments, which also delivers greater transparency due to the originator bank receiving a message confirming settlement.

This efficiency gain contrasts strongly with the situation in the world of cross-border payments. As a general rule, the settlement of small-value cross-border payments still takes several days, as it involves many different parties. There is often a lack of transparency in this process when it is not clear who is currently processing the credit transfer or when the payment will be received by the recipient. Furthermore, the costs of remittances, particularly in low and middle-income countries, are very high. In the case of small-value remittances, the fees alone currently represent 6.5% on average of the total amount sent (see further information). This places a particular strain on migrant workers in industrial countries who send money to their home countries. In addition, not everyone is directly connected to the banking network, especially in countries in the global south – often people only have access to financial services via their mobile phones.

The G20 countries therefore see a clear need to act to make cross-border payments more efficient and, at the same time, to provide more people with access to the international payment network. Improvements in this area, such as through measures to reduce settlement costs, would result in a larger proportion of credit transfers being received by their recipients. This would, not least, promote financial inclusion and economic development in middle and low-income countries, which would in turn help the world’s poorest people. At the same time, a shift in payments to closed private sector systems should be prevented to ensure that countries remain in control of their monetary system.

amplus project

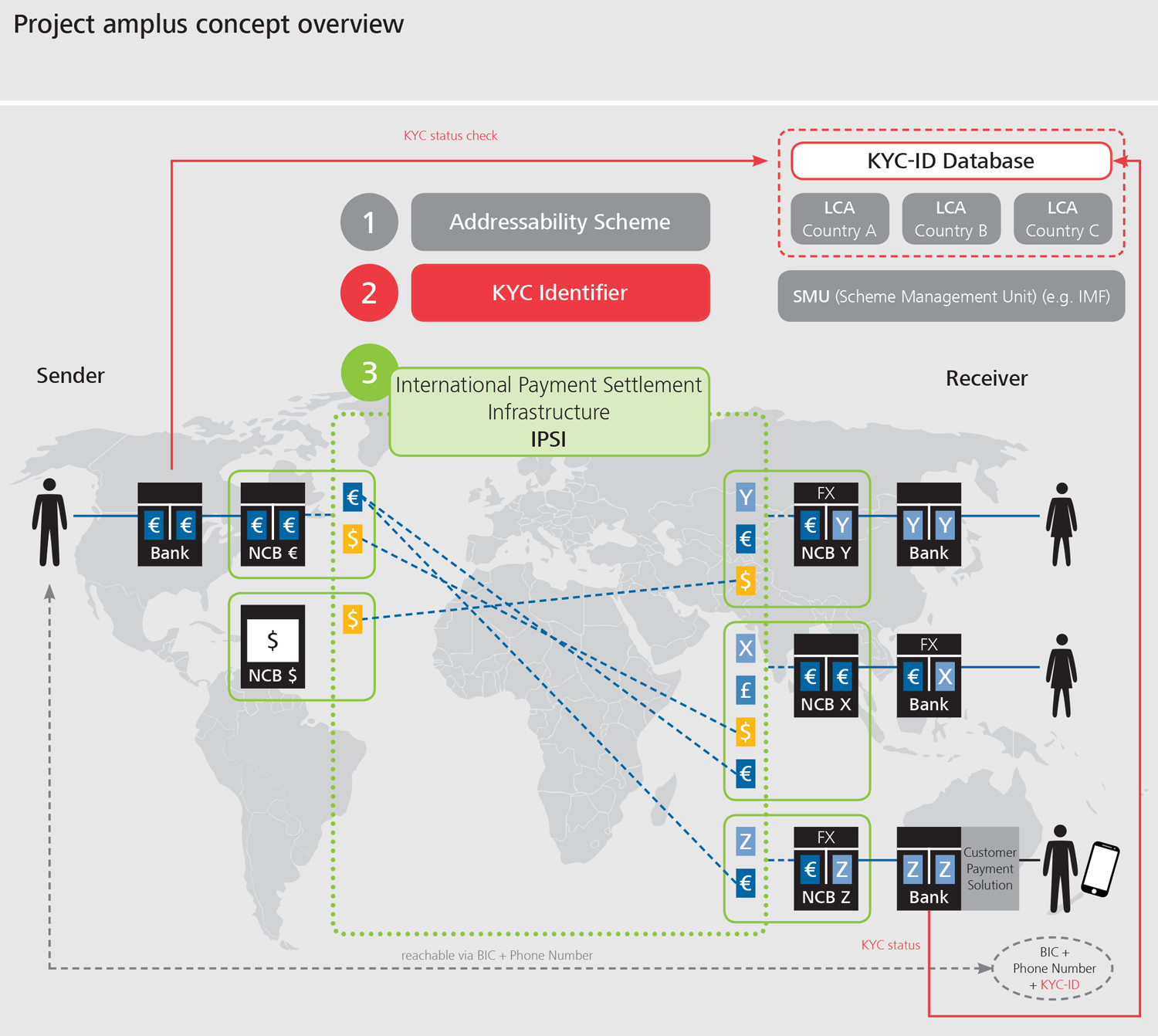

With a view to enhancing the efficiency of cross-border payments whilst at the same time giving more people access to international financial services, the Bundesbank, during G20 discussions (see further information), put forward three modules for improving remittances referred to together as “amplus”. So far, this has merely been a contribution to the international debate and not an implementation project.

- Introduction of a single element for the addressability/identification of people with and without bank accounts (addressability scheme)

- Introduction of a standardised and unique element for “know-your-customer” processes (KYC identifier)

- Creation of an international payment settlement infrastructure (IPSI)

Addressability scheme

Particularly in developing countries and emerging market economies, many people do not have a traditional bank account and are therefore unable to receive direct international bank transfers. Nevertheless, many have a mobile phone that gives them access to financial services. The introduction of a standardised single element consisting of a BIC (business identifier code) and an identifier such as a person’s mobile phone number could enable clear identification and a transition from account payments to smartphone-based wallets. In this way, even people without access to a traditional bank account could receive and send payments internationally. This is made possible by a partnership between mobile payment solutions and banks that are embedded in a specially established global governance structure. The aim of this is to provide uniform standards that ensure open and fair access for all interested parties.

KYC identifier

Cross-border payments are subject to strict compliance regulations, particularly those to combat money laundering (AML) and counter terrorist financing (CFT). In order to comply with these rules, it is important that banks and financial service providers are able to unambiguously identify their customers by performing know-your-customer (KYC) checks. In addition, all payments must be compared against the relevant sanctions lists as part of CFT checks. This is a particular challenge in recipient countries of remittance payments. Using a single KYC identifier to standardise these processes would facilitate cross-border payments. Local competent authorities could maintain databases in which they assign KYC attributes to individuals. Under the supervision of the IMF, these databases could be fed into a global structure in which it would only be noted whether a payment may or may not be made. To support this, it would also make sense to consider the introduction of a KYC “light” regulation as a minimum requirement for very small payments with limited risk.

This would provide regulatory coverage for small-value payments in certain low-risk payment corridors – i.e. “safe” payment corridors – and banks would be able to carry out these payments with significantly less time-consuming compliance checks. As a result, remittance payments would not only be cheaper, but would even be possible in many corridors with low payment volumes.

IPSI

The international payment settlement infrastructure (IPSI) could enable the establishment of a single shared multilateral platform for the settlement of cross-border payments, with which only national central banks could open accounts. Liquidity would be provided exclusively by the participating national central banks. This concept does not cover the settlement of cross-currency payments for the time being, meaning that exchange rate risks are ruled out. However, central banks could maintain several accounts in different currencies. The shared platform would allow small-value payments to be processed indirectly via the central bank. If person A sent money to person B in another country, person A’s bank would then notify the central bank, which would settle the payment with the central bank of the recipient country via the IPSI. The central bank of the recipient country could, in turn, settle the payment directly with the recipient’s bank. The number of financial intermediaries involved would be reduced for the majority of remittance corridors, saving time, lowering costs and increasing transparency. Payment settlement in the IPSI would need to be possible 24 hours a day, 7 days a week, 365 days a year. The platform could be operated by the Bank for International Settlements (BIS).