Macroeconomic time series

The Bundesbank provides its own macroeconomic time series on various topics for display and download.

-

The time series are grouped in lists, which are organised in a hierarchical tree structure. You can access this directly by clicking on the menu item “Time series databases” and making a selection, eg “Macroeconomic accounting systems”.

The time series database tree allows you to search for all the available topics in the database step by step. You can open and close the individual nodes of the tree structure with a single click. Your selected path takes you directly to the available time series lists. Click on the time series of your choice in the time series list to display it as an HTML page.

-

You can view a time series by clicking on the Values, Chart, Attributes and Tables tabs and you can switch between these as required.

Values

The table of values for the time series contains data on time, value and status for each individual observation as well as the relative or absolute period-to-period and year-on-year change where appropriate. These changes are calculated from the unrounded time series values, and from hypothetical euro-based values where appropriate. The data in the "value" and "change" columns may therefore differ from one another on account of rounding.

Each time series value may have a value status describing it in more detail.

Graphs

All the values in the table of values can also be shown in a graph. You can adjust the graph by restricting the time period and selecting the (period-to-period/year-on-year) change.Click on "Update graph" to confirm your changes.

Attributes

The following time series attributes are shown:

Attributes of a time series

Attribute

Definition

Possible values

Unit

Unit in which the time series values are entered.

eg DM, euro, DM/euro, 1995=100

Unit multiplier

Factor by which the data must be multiplied in order to obtain the actual values

One, ten, hundred, thousand, ..., billion

Timespan

First and last dates entered

eg 2000-01 to 2000-12

Last update

Timestamp of last update

eg 2005-05-24 12:00:47

Further possible attributes include general comments, or comments on source, methodology or specific observations as well as information on the form of conversion used for the time series.

Tables

This page shows a list of all the tables in which the time series currently under observation appears.

-

-

DM/euro series

In national analyses, the irrevocably fixed exchange rate is often also assumed for the past in order to avoid breaks in time series. However, this procedure becomes problematic when historical data for different countries are converted into euro and then aggregated or compared with one another, since it is incorrectly assumed that the exchange rates between the national currencies were already fixed in the past. This can result in a distorted representation of the interplay between real and monetary processes within and among the economies.

Series given as DM/euro are stated in DM until December 1998 and then in euro. The rates of change in the "Year-on-year percentage change" and "Period-to-period percentage change" columns are calculated solely in euro.

These time series can be downloaded as they are or solely based on euro.

For the direct download, only the option specified in the attributes of the time series is available.

Statistical breaks

The DM/euro-denominated non-seasonally adjusted series showing outstanding amounts may contain statistical breaks which are not individually noted.

Assets and liabilities of banks in Germany

Firstly, we recommend reading the methodological notes in Statistical Series „Banking statistics“.

The results for each of the most recent reporting dates are always provisional. Changes as a result of subsequent revisions, which are included in the publication for the following reporting date, are not specifically noted.

The statistics on banking business in Germany do not contain the assets and liabilities of branches of German banks abroad; however, they do include the business of branches of foreign banks in Germany.

Statistical exceptional trends are not noted in the series showing outstanding amounts. As a result of changes in the reporting sample or the survey forms/reporting methods, there were large statistical breaks in the time series at the following times:

Date

Comment

December 1959

Inclusion of credit institutions in Saarland in the reporting sample

December 1960

Inclusion of housing promotion institutions in the reporting sample

December 1985

Inclusion of small cooperative banks – which until then had not been required to report – in the reporting sample.

June 1990

Inclusion of east German credit institutions in the reporting sample

January 1995

Adjustment of banking statistics to the Federal Statistical Office's "classification of economic activities", 1993 issue (WZ 93).

January 1999

Conversion of the German banking statistics as part of harmonisation within European monetary union, involving the following changes:

Inclusion of building and loan associations' reporting data;

Treating building and loan associations as banks (previously non-banks) for the sectoral classification of counterparties of those required to report;

Changes and limitations to the time window for assets and liabilities;

Removal of assets and liabilities arising from fiduciary services from the classification of loans and deposits.External position of non-banks

(Exposures and liabilities of German enterprises vis-à-vis foreign institutions).

This primarily includes exposures and liabilities of domestic enterprises (including individuals) vis-à-vis non-residents arising from financial relationships and trade credit (credit terms and advances). It does not include participating interests in foreign enterprises, non-residents' participating interests in the equity capital of domestic enterprises or securitised assets and liabilities vis-à-vis non-residents. Purely statistical inflows and outflows are not eliminated; changes in outstanding amounts are not comparable in this respect with the data on long and short-term capital movement shown in the balance of payments. As a result of changes in the reporting sample, there were large statistical breaks in the time series in the following months:

Date

Comment

September 1982

Exemption limit raised from DM100,000 to DM500,000

June 1990

East German credit institutions included in the reporting sample

December 1995

Exemption limit raised from DM500,000 to DM 3 million

March 2002

Exemption limit raised from DM3 million (around €1.5 million) to €5 million

The current time series can be found in table form under "Current figures/External sector/II External stock statistics, Assets and liabilities of enterprises in Germany vis-à-vis non-residents".

- In total, and by foreign currency and euro;

- by group of countries;

- by individual country

Foreign direct investment stock statistics

In April 2020, the Special Statistical Publication 10 "Foreign direct investment stock statistics" was replaced by the Statistical Series "Direct investment statistics".

The corresponding methodological notes are also included here.As of reporting year 2013 the foreign direct investment stocks are shown backdated to the year 2010 based on new internationally harmonized calculation requirements of the OECD Benchmark Definition, 4th edition. Therefore these data are presented separately from the data based on the previous national calculation requirements, which were used until 2012.

The results for each of the most recent reporting dates are always provisional. Changes as a result of subsequent revisions are not specifically noted.

International harmonization has led to the following changes in methodology over time:

Date

Type of change

1993

exemption limit on the balance sheet total of investment objects raised from DM500,000 to DM1 million (see also point 1 below)

1999

exemption limit reduced from a 20% share in capital and voting rights to less than 10%; exemption limit for minority interests (stake under 50%) for the balance sheet total of investment objects raised to DM 10 million or €5 million, exemption limit for majority shareholdings (50% or more) left at DM1 million or €500,000

2002

a standardized exemption limit for the balance sheet total of investment objects set at €3 million (see also point 2 below)

2007

all cross-border indirect majority shareholdings recorded if the balance sheet total of investment objects exceeds €3 million

indirect minority shareholdings no longer recorded (see also point 3 below)

2013

disclosure of the foreign direct investment stocks based on new internationally harmonized calculation requirements of the OECD Benchmark Definition of Foreign Direct Investment, 4th edition, backdated to reporting year 2010 (see also point 5 below) The following excerpts from our Special Statistical Publication 10 "Foreign direct stock investment statistics" (previous title "International capital links") provide information on the implications of the changes in exemption limits as well as changes in methodology.

1. Information on the rise in the exemption limit from our Special Statistical Publication 10, "International capital links", May 1995:

The exemption limit for the balance sheet total of investment targets was raised from DM 0.5 million to DM 1 million in 1993. Consequently, approximately 2,300 enterprises abroad with German participating interests and about 1,200 enterprises in Germany with foreign participating interests were no longer required to report. In the case of German direct investment abroad, direct investment assets declined by no more than approximately DM 400 million as a result; in the case of foreign direct investment in Germany, they declined by approximately DM 300 million.

2. Information on the change in the exemption limit from our Special Statistical Publication 10, "International capital links", May 2004:

A newly restandardised exemption limit applying to the balance sheet total of investment enterprises took effect for the first time in 2002. The increase from €0.5 million to €3 million meant that, compared with the previous year, the number of enterprises required to return reports decreased by approximately 11,800 for those enterprises abroad with German participating interests and by some 4,600 for those enterprises in Germany with foreign participating interests. At the same time, lowering the exemption limit for the balance sheet total of the investment targets of enterprises with a minority interest from €5 million to €3 million year on year led to some 300 enterprises abroad with German participating interests and approximately 200 enterprises in Germany with foreign participating interests being included for the first time. All in all, this resulted in a €7 billion reduction in the volume of German direct investment abroad and a €2 billion reduction in the volume of foreign direct investment in Germany.

3. Information on the change in the exemption limit from our Special Statistical Publication 10, "Foreign direct investment stock statistics", April 2009:

As of the end of 2007, all cross-border indirect participating interests are recorded in which a majority participation is held and the balance sheet total of the investment object exceeds €3 million. This led to the additional recording of around 1,000 indirect majority participating interests abroad and around 600 indirect majority participating interests in German enterprises. At the same time, the reporting of indirect minority participating interests in enterprises was suspended. In the case of German direct investment abroad, this affected more than 800 indirect minority participating interests and in the case of foreign direct investment in Germany, almost 600 indirect minority participating interests were affected.

4. Information on changes to the way data on investment objects are recorded from our Special Statistical Publication 10, "Foreign direct investment stock statistics", April 2009:

As part of the change to the way data are recorded, the data for dependent holding companies are also included as of the end of 2007. In the case of German direct investment abroad, this resulted in an increase in the number of investment objects of almost 1800, while in the case of foreign direct investments in Germany, the number increased by almost 1300.

5. Information on changes in calculation requirements according to the OECD Benchmark Definition of Foreign Direct Investment, 4th edition, from our Special Statistical Publication 10, "Foreign direct investment stock statistics", April 2015:

In a departure from the previous gross figures, capital links within multinational groups are netted, loans to investors are deducted and cross-border affiliated loans are allocated according to the domicile of the group's headquarters. Thus, if the group's headquarters are domiciled in Germany, the affiliated credit relationships of the enterprises in Germany are counted as positive (in the case of lending) or negative (in the case of borrowing) German foreign direct investment abroad, which is referred to as outward foreign direct investment. If the group's headquarters are domiciled abroad, the affiliated loans of the enterprises in Germany are recorded as positive (borrowing) or negative (lending) foreign direct investment in Germany, which is also called inward foreign direct investment.

Selected seasonally adjusted business statistics

Seasonally adjusted figures are calculated using estimation methods and are subject to a degree of uncertainty. This means that minor changes from one period to the next in the last place of the displayed figures are also not necessarily indicative of economically induced changes. The series are usually reproduced with a degree of accuracy which allows the mainly rounded rates of change stated in the Bundesbank's analyses to be verified.

More information on seasonal adjustment:

-

-

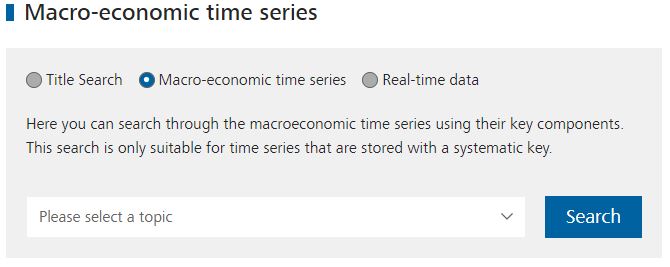

Direct to search

-

The components of the selected DSI's time series key will appear at the bottom of the site.

Clicking on the „Show list“ of the key components table opens the code list view.

You can select and apply one or more codes from the list. The key component table also offers the option to enter codes manually. Click to apply the code that you have entered.

By clicking on the „Show selection” the hits will be displayed in a results list.

Direct to search

-

The search will produce a list of hits. From this results list, you can add individual or several time series to your data basket, download them as a CSV or SDMX-ML file or load them in the time series view.

You can adjust the number of results displayed on each page by clicking „Results per page“ on the right-hand side above the results list.