January results of the Bank Lending Survey in German

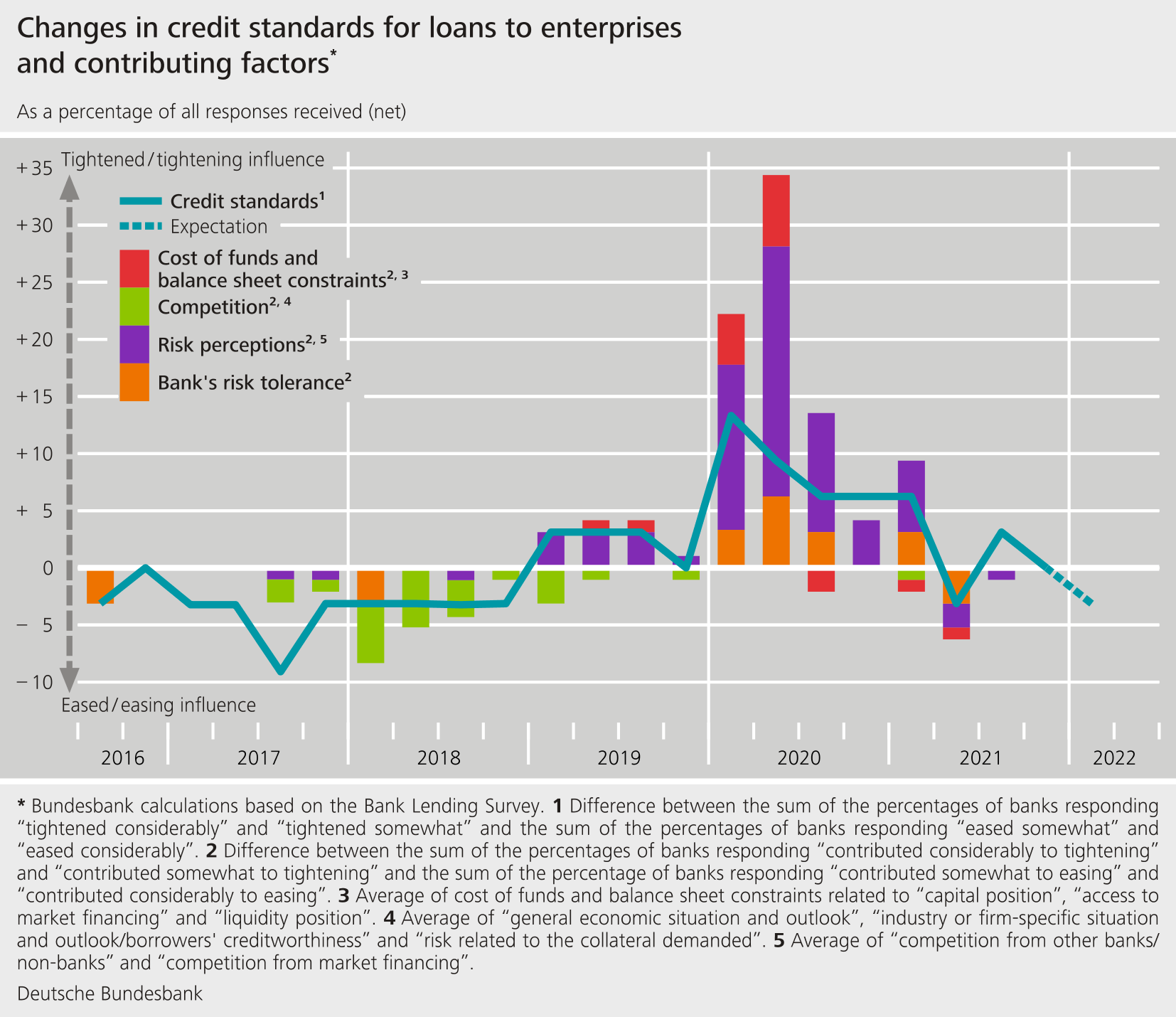

- The German banks responding to the Bank Lending Survey (BLS) left their credit standards for loans to enterprises and for consumer credit and other lending to households unchanged in the fourth quarter of 2021. Credit standards for loans to households for house purchase were marginally tightened.

- Credit terms and conditions for loans to enterprises and also for loans to households were eased. This was reflected chiefly in narrower margins.

- The NPL ratio had no meaningful impact on lending policies in the second half of 2021. The banks are not expecting any meaningful influence for the first half of 2022, either.

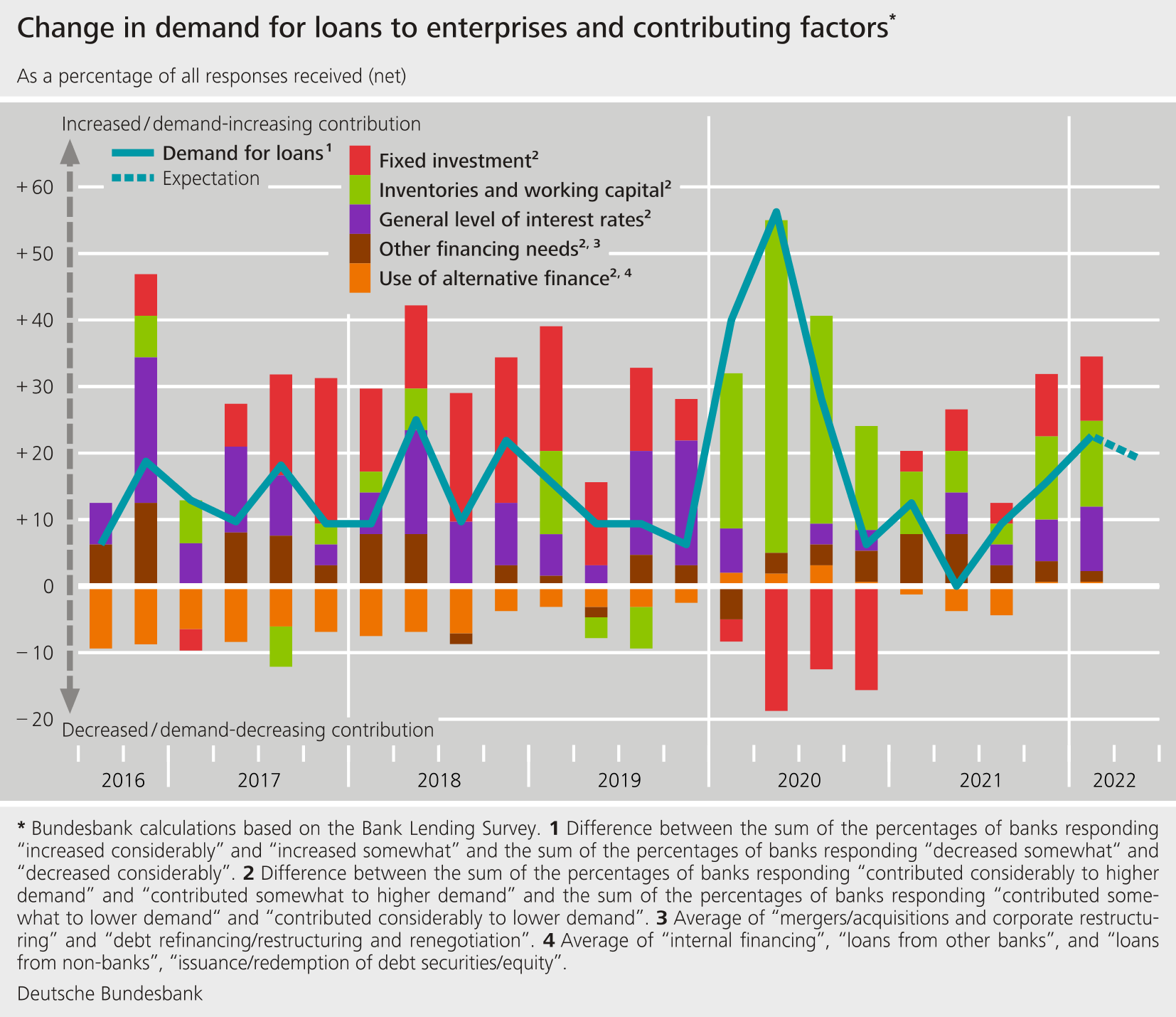

- Demand for loans to enterprises and for loans to households increased further. Corporate demand among large enterprises for government-guaranteed loans granted under the coronavirus assistance programmes continued to decline in the second half of 2021. Among small and medium-sized enterprises, it picked up marginally following the decline in the first half of 2021.

- In the second half of 2021, banks left their credit standards largely unchanged in nearly all surveyed sectors of the economy. Only in the commercial real estate sector did they report a discernible tightening.

The January BLS round contained ad hoc questions on the banks’ funding conditions and the impact of the new regulatory and supervisory activities relating to capital, leverage, liquidity or provisioning, as well as on the impact of non-performing loans (NPLs) on banks’ lending policy. It also contained a question on lending policy and loan demand in the key economic sectors as well as a question on loans with COVID-19-related government guarantees.

Against the backdrop of conditions in financial markets, German banks reported an improvement in their funding situation compared with the previous quarter. Banks responded to new regulatory and supervisory activities by continuing to strengthen their capital position last year. In the second half of 2021, consistent with banks’ expectations, the size of the NPL ratio (percentage share of NPL stocks (gross) to the gross book value of loans) had only a marginal impact, or none whatsoever, on lending policy. For the first half of 2022, too, the banks are not expecting the NPL ratio to exert any meaningful influence on their lending policy. In the second half of 2021, German banks left credit standards largely unchanged in nearly all surveyed sectors of the economy. Only in the commercial real estate sector did they report a discernible tightening. For the first half of 2022, banks are planning to ease their standards for commercial real estate lending and to tighten standards for loans to the residential real estate sector. Banks reported a continued decline in demand for loans to enterprises with COVID-19-related government guarantees among large enterprises in the second half of 2021. The reason cited for this was a reduction in the need for funds for fixed investment and to substitute existing loans. Demand amongst small and medium-sized enterprises rose marginally because more funding was once again requested in order to meet acute liquidity needs.

The Bank Lending Survey, which is conducted four times a year, took place between 13 December 2021 and 11 January 2022. In Germany, 34 banks took part in the survey. The response rate was 100%.