Results of the survey on the profitability and resilience of German credit institutions in a low-interest-rate setting

The survey showed that the persistently low interest rates weighed significantly on German credit institutions in all survey scenarios over a five-year period. However, given the existing surplus capital and available hidden reserves, most institutions will be able to withstand the strains caused by the low-interest-rate setting. This is the outcome of the most extensive survey to date performed by the Deutsche Bundesbank and BaFin, which covers roughly 1,500 small and medium-sized German credit institutions, also known as less significant institutions (LSIs). The surveyed commercial banks and savings banks are supervised directly by BaFin and the Bundesbank. The survey did not cover the 21 major German institutions under direct supervision by the European Central Bank.

According to Andreas Dombret, the Deutsche Bundesbank's Executive Board member in charge of banking supervision, "we find the results in all surveyed interest scenarios to be quite worrying indeed"

. He noted that this was particularly the case in the constant or falling interest rate scenarios and even in the scenario of an interest rate increase. "Judging by these results, it would be irresponsible for the surveyed credit institutions to sit out the current situation, and for some it would even be hazardous,"

Dombret continued. This is why banks needed to take counteractive measures early on, he added. However, there is also one aspect which provided grounds for solace: "In the meantime, most banks have accumulated enough reserves to make it through the low-interest-rate phase,"

said Raimund Röseler, BaFin's Executive Director for Banking Supervision. He added further that "we will make sure that the reserves are also available in a crisis and that, should it be necessary in isolated cases, we will take the requisite measures."

The survey results have given supervisors extensive insights into German institutions' earnings prospects, enabling potential risks among individual credit institutions to be detected at an early stage.

The survey is based on five interest rate scenarios. First, institution-specific target and forecast data were collected. Second, the credit institutions were asked to simulate their earnings in four pre-defined interest rate scenarios (see Table 1).

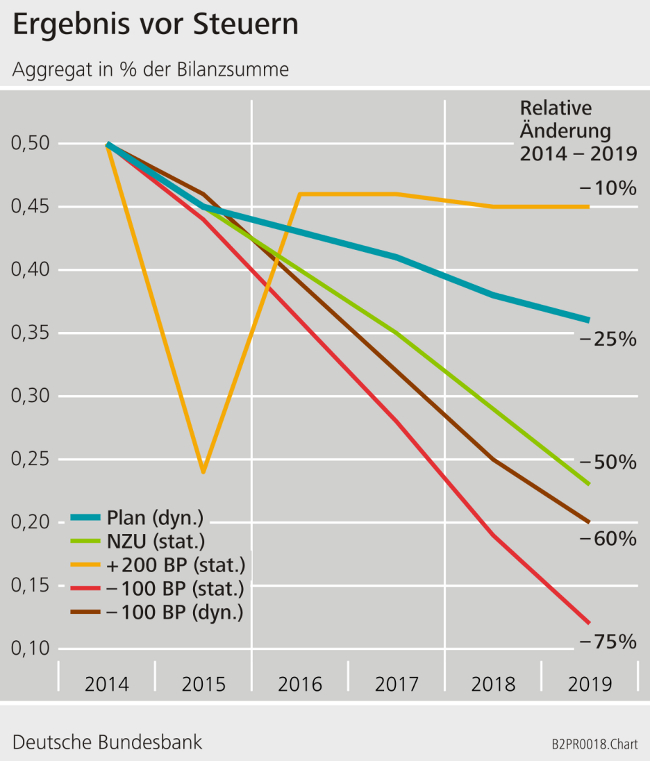

Looking at the growing strains caused by the low-interest-rate environment, the credit institutions as a whole expect pre-tax profit to fall by around 25% by 2019 – even despite the upbeat economy at present and scheduled cost-cutting measures. In two of the four pre-defined interest rate scenarios, aggregate earnings drop by more than 50%; in one, even by as much as 75% (see Figure 1).

The survey also reveals that profits are likely to fall considerably if the low-interest-rate setting persists. This is largely due to contracting margins in borrowing and deposit business, such as in the area of savings and transferable deposits.

To gauge the impact of a deterioration in credit quality on institutions' capital adequacy, stress tests for credit risk and market risk were also added to the survey (see Table 2). These simulations showed clearly that, since 2011, the institutions have been holding a small amount of riskier assets in their portfolios and have been expanding their average residual maturities in their proprietary business, exposing themselves to higher default and market risk. Most credit institutions, however, have sufficient hidden reserves at their disposal to cushion the stress effects of default risk and market risk.

German supervisors will intensively monitor particularly vulnerable credit institutions and – if necessary – take measures to enhance their resilience. Institutions, especially those with business models that depend heavily on interest income, will, in the medium to long term, need to reassess their strategies.

Table 1: Overview of interest rate scenarios, 2015-19

| Designation | Balance sheet structure | Term structure |

| Target | Dynamic | Institution's assumptions |

| Low-interest-rate setting | Static at 31/12/2014 | Constant at 31/12/2014 |

| Positive interest shock | Static at 31/12/2014 | +200 BP vs 31/12/2014 |

| Negative interest shock (stat) | Static at 31/12/2014 | -100 BP vs 31/12/2014 |

| Negative interest shock (dyn) | Dynamic | -100 BP vs 31/12/2014 |

The simulations cover a five-year horizon from 2015-2019. The supervisory scenarios include a continuation of the low-interest-rate setting, an abrupt rise in interest rates and further falling interest rates. The falling-rate scenario included, for the first time, a study of the impact of negative interest rates.

Table 2: Stress test assumptions, 2015-19

The credit risk stress test assumed two scenarios with a rise in the probability of default (PD) and collateral value losses. In the market risk stress test, the credit institutions simulated the impact of a rise in credit spreads on market values and reportable proprietary trading losses.

| Designation | Balance sheet structure | Shock | |

| Credit risk (scenario 1) | Static at 31/12/2014 | PD: +60% | Haircut: 10% |

| Credit risk (scenario 2) | Static at 31/12/2014 | PD: +155% | Haircut: 20% |

| Market risk | Static at 31/12/2014 | Rise in credit spreads | |

| Rating | Spread increase (bps) |

| AAA | 30 |

| AA | 50 |

| A | 100 |

| BBB | 200 |

| BB | 500 |

| B | 1,000 |

| CCC or poorer | 1,500 |

Figure 1: Fall in pre-tax profits in each scenario, 2015-19

in german only

Statement

in German only

Download

in German only